EU ETS myth busting: Why it can’t be reformed and shouldn’t be replicated

This report has been co-published by more than 40 organisations, including Corporate Europe Observatory (see complete list of signatories at the end). It shows that far from being the ‘best tool’ to combat climate change, the EU ETS is inherently too weak to drive the sustainable energy transformation the EU needs in order to stay within global warming limits. It is systemically flawed and cannot be fixed.

Given the urgent need to keep global warming within 1.5 degrees or less, it is vital that the European Union (EU) gives itself the best tools with which to reduce greenhouse gas emissions. In 2005, the EU launched its ‘cornerstone policy’to reduce emissions — the European Union Emissions Trading System (EU ETS) (see box 1). However, since the adoption of the EU ETS, emissions have risen; there is increased reliance on coal; the price of consumer energy has risen along with the profits of many industrial actors (as a direct result of the EU ETS) and millions of euros of public money have been lost in VAT fraud. Despite this troubling track record, key decision makers such as Connie Hedegaard, European Commissioner for Climate Action, and many policy makers in the EU, remain convinced that the EU ETS is a success and should remain in place for Phase III – until 2020 and beyond.This report will show that far from being the ‘best tool’ to combat climate change, the EU ETS is inherently too weak to drive the sustainable energy transformation the EU needs in order to stay within global warming limits. It is systemically flawed and cannot be fixed.

Proponents of carbon trading claim that the main flaws within the EU ETS are a result of poorly designed or badly applied rules. This report gathers statements from senior EU officials that continue to argue that the EU ETS has ‘worked’ in the past and will continue to do so in the future, despite the evident failure of the EU ETS to meet its own objectives.1 Their conclusion is therefore that it can be reformed. To this end, the European Commission is currently consulting on six potential reforms to modify the EU ETS.2 This report provides evidence to show that such reforms will never result in a functioning market, let alone transform the EU ETS into a tool that enables the EU to sustainably reduce its emissions.

Claims that the market can be reformed are based on myths that this report dismantles by comparing them to reality. One key myth that this report refutes is the belief that the EUETS is a flexible tool with which to reduce emissions – explained in detail under Myth 3. The fundamental characteristics of the EU ETS mean that it is very difficult for it to respond to changes in supply and demand, in reality making it a cumbersome tool with which to regulate emissions3. Even creating ad-hoc discre- tionary price mechanisms for the ETS will never be suffi- cient to stabilise the supply of permits on the market.4

Another key myth is that the EU ETS is able to function properly, and that the current problems are merely related to oversupply. The authors of this report believe the problems with the EU ETS run far deeper and have to do with the very commodity being traded – explained under Myth 5. Issues to do with the methodology of commod- itising pollution mean it is very open to fraud, notably because it is not a physical commodity and has no natural buyers or sellers. These issues cannot be resolved. The problems that have led to the market’s collapse are rooted in the core structures of the EU ETS. This is why our report concludes by demanding its end to the post-2020 in order to make space for real climate action.

Myth 1“The EU ETS is the best tool for reducing emissions”.5 Reality Emissions rose in Phase I (2005–2007). In Phase II (2008–2012) decreases in emissions were not linked to EU ETS but rather to the economic crisis. Myth 2“The EU ETS acts as a major driver of investment in clean technologies and low-carbon solutions”.6 Reality Phases I & II of the EU ETS have not triggered transformational investment in sustainable renewable energy or low-carbon technology. Myth 3“The EU ETS is a system that is functioning as intended, and it is flexible”.7 Reality The EU ETS is a cumbersome, unresponsive mechanism which has failed to achieve its own objectives. Myth 4“The EU ETS is delivering cost-effective emissions reductions”.8 Reality The EU ETS has not been cost-effective for either the public or consumer purse. Myth 5“The positive thing is that the ETS is working”.9 Reality The EU ETS is a Fraudsters’ Paradise, fostering tax evasion, fraud, and other criminal activities. |

…and must not be replicated

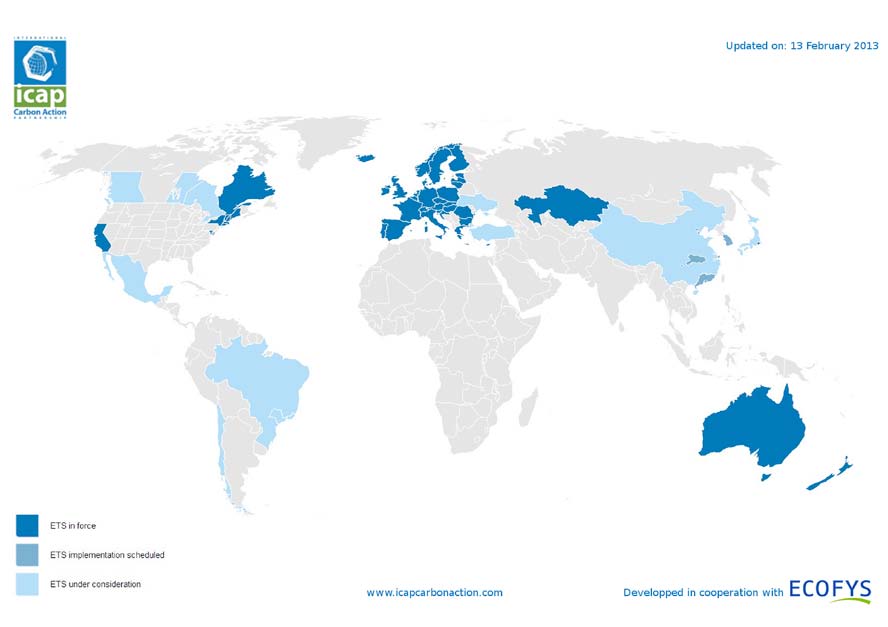

Despite its many flaws, the EU ETS is being held up as an example for other countries to follow. In the midst of panicked discussions about how to save the EU ETS, the EU continues to encourage other countries to adopt Emissions Trading Schemes as the best tool to reduce emissions (see image above for a map of which countries are currently engaging in emissions trading systems, according to Ecofys). One example of such encouragement is the Partnership for Market Readiness (PMR), a joint EU and World Bank initiative that provides funding and technical assistance to 16 ‘middle-income’ countries to set up emissions trading systems.10

Perhaps even more worrying is that there seems to be a push for the principles of carbon trading to move beyond carbon into commercialising other parts of nature. The assumption that trading “works” has led to a paradigm shift in how countries deal with environmental protection. Pricing mechanisms like the EU ETS are being proposed to replace direct regulation and the setting of strong pollution limits in areas beyond carbon. In its communication on the Rio+20 conference, the European Commission (EC) claimed that “experience shows that market-based approaches such as emissions trading are not only costeffective tools to address environmental problems but are also a source for investment”.11 Carbon trading has set in motion a creeping commodification of nature that offers profits for traders, but paltry protection for the natural environment or communities living on and around the territories affected by either the offset projects or the industrial facilities that are allowed to continue polluting in the first place.12

To reduce emissions at source by the required amount, real changes in terms of EU consumption, production and infrastructure are needed, which will require making difficult political decisions to be made. The EU ETS was set up in order to allow the ‘market’ to produce this change, but with so many vested interests at stake and structural loopholes, it is doomed to fail. What the EU needs is an open, science-and-justice-based debate about the climate actions we need, and the policies that will make them work. At a time when the trading model is being pushed into other areas of nature, this report explains why the EU ETS can’t be reformed and should not be replicated.

Box 1 EU ETS: The basicsThe EU ETS is meant to ensure high-emitting industry sectors deliver their share of the emission reductions that the EU has taken on under the Kyoto Protocol. The EU ETS covers approximately 11,000 plants in high-polluting industrial sectors across the 27 EU Member States, plus Norway, Liechtenstein, Iceland and Croatia. These industrial sectors include power generation, oil refining, iron, steel, cement, lime, glass, ceramics, and pulp and paper.13 The sectors covered by the EU ETS represent around 40 per cent of total EU emissions. Other approaches such as direct regulation are being used to reduce emissions in other sectors. The EU ETS functions through two mechanisms: the ‘cap-and-trade’ systemwhich allows companies under the system to trade allotted carbon permits; and the ‘Linking Directive’ which allows installations to buy carbon credits generated from ‘emissionssaving’ or ‘offset’ projects. These projects are implemented in other countries, primarily in the global South. Banks, investment funds, and brokers can also trade in permits and credits, and a range of derivative products such as ‘futures’ based on these permits and credits. |

Myth 1

“The EU ETS is reducing emissions”

Reality: Emissions rose in Phase I (2005-2007), and in Phase II (2008-2012), decreases in emissions were not linked to the EU ETS

The myth that the EU ETS is reducing emissions is still actively supported, despite significant evidence that it is not. This is particularly problematic for three reasons. First, the annual emissions reductions figures provided by industry are highly dubious since they are calculated using proxy measures, such as the amount of coal burnt. There are no sensors in smokestacks that can measure actual CO2 emissions, nor are there plans to put them there. As long as no reliable figures are available, it will remain impossible to dismiss the suspicion that we are paying a high fiscal cost for very, very small and unverifiable reductions.

Second, this myth is problematic because it is difficult to prove whether emissions have geuinely been reduced or moved elsewhere. Under the Kyoto Protocol, only emissions generated from production are accounted for, not those from consumption. Taking China as an example, 22.5 per cent of its total emissions are linked to its exports, so if the EU’s emissions go down, it could be because more and more production is being outsourced to China, (thereby actually increasing global emissions, since there are even more lenient environmental regulations in China than in Europe.)14Consequently, it is impossible to tell if the EU’s emissions are really falling.15

Box 2: Overallocation and windfall profitsThe allocation of free EU ETS permits was a generous gift presented to the EU’s largest polluters. Permits were received at no cost, but the anticipated ‘opportunity cost’ was passed on to consumers. Electricity utilities, for example, earned an estimated €23–71 billion in windfall profits in phase II alone.16 There was a similar situation for the manufacturing sectors. The two steel manufacturing giants, ArcelorMittal and Tata Steel Ltd, were awarded 62.4 million more free carbon permits in 2011 than they used, which is more than any other European company. In Phase III (2013–2020), the giveaway continues: a study for green transport group T&E estimated that “European airlines may have earned up to EUR 486 million in 2012 from passing carbon costs that never materialised on to their customers. The UK government notes it is up to airlines themselves to decide whether they want to return these profits.”17 |

Third, this myth is problematic because it cannot be verified. Estimates of the emissions reductions in Phase II if the EU ETS that can be attributed to carbon trading are not available from the EC. It is therefore unclear on what evidence the Commissioner for climate action bases her statement that “the ETS is delivering real emission reductions.”18 Though there was a temporary reduction of emissions in the EU between 2008–2010, it is widely acknowledged that this was due to the economic crisis, which caused a significant slow-down in industrial output. 19 As a result, a number of studies agree that there is little evidence pointing towards a causal link between emissions reductions and the EU ETS.20 The rise in emissions during a temporary economic recovery in 2010 further supports the argument that there has not been a fundamental shift in how energy is produced, or how industry uses it.

In reality, the over-allocation of permits in Phase I (see box 2)has meant that there was no incentive to reduce emissions (beyond marginal emissions savings from reducing energy and heat wastage) since the large majority of companies had permits in excess of their emissions levels.21 In Phase I, industries under the cap received 41 million surplus credits every year; by the end of Phase I emissions in the EU were 26 million tonnes higher than in 2005.

Industries covered by the EU ETS negotiated allocations of permits on the basis of wildly inflated estimates of their historic emissions and projected needs, meaning they did not have to reduce emissions at all. As a result of the overallocation of permits, their price stayed low and emissions rose by about 7.5 per cent.22

Myth 2

“The EU ETS acts as a major driver of investment in clean technologies and low-carbon solutions”

Reality: Neither Phase I nor II of the EU ETS has triggered transformational investment in sustainable renewable energy or low-carbon technology

The EU ETS is supposed to have sent a signal to polluting businesses to prompt them to investment in low-carbon technology and so have to buy fewer permits. Due to the massive over-allocation of permits (see box 2), polluting continued to be the cheapest option for businesses. Consequently, few if any investments into transforming energy infrastructure, production or use as a result of the EU ETS were made.

In reality, the EU uses more coal today than it did in 2005 – with the highest coal consumption levels since the 1960s. Though this is also due to a number of geopolitical and geo-environmental issues (notably that the USA is exporting more coal because it is consuming more unconventional gas), independent commentators have said that the EU ETS has played a pivotal role in causing the increase in coal consumption in Europe.23 With strong environmental measures in place, such as a maximum carbon content of electricity, the EU could have avoided such a situation and been less reliant on energy imports.

Even more worrying is that the EU ETS is now actively encouraging the consumption of coal. By making ‘price’ the only factor to consider in terms of the CO2 released from energy generation, coal consumption has risen, as one energy broker commented:

“With prices at 18-month lows, everyone feels a bit more inclined to use coal at the moment. [The low permit price] is encouraging people to shoulder shrug, and say ‘We’ll just go ahead and use coal’. That is the signal that the emissions market is giving off.”24

Though there has been a rise in the number of low-carbon patents being declared, independent academic work reveals that the impact has been minimal. According to the authors,

“only 2 per cent of the post-2005 surge in low-carbon patenting can be attributed to the EU ETS... our findings suggest that the System so far has had at best a very limited impact on the overall pace and direction of technological change. ”25

There is an additional problem with regards to what the EU ETS is terming ‘clean energy’ and ‘low-carbon’ solutions. One particular problem regards biomass. The EU ETS defines biomass-based energy as ‘carbon neutral’, and requires that no permits need to be purchased for energy production from biomass. Large energy producers have therefore converted their existing power plants to (inefficient) coal and biomass co-firing systems. But when the entire production cycle is taken into account, biomass energy production is far from carbon neutral. The carbon neutral definition of biomass energy creates a perverse incentive for Member States and energy companies to invest in biomass fuels despite the associated land use, impacts, transport and ‘smokestack’ emissions, and concern about the amount of land required to satisfy the high demand for wood pellets. New studies warn that large tracts of land (and many local livelihoods) are at risk from the expanding biomass industry, including rising exports to meet EU demand. Deforestation and the subsequent expansion of industrial tree plantation for ‘bioenergy’, marketed as a substitute for fossil fuels, is set to cause a spike in atmospheric carbon over the next 35–50 years, according to analysis that examined 17 existing and 22 planned biomass plants in seven states.26

According to the Massachusetts Environmental Energy Alliance, based on statistics from the US Environmental Protection Agency, ‘smokestack’ CO2 emissions from biomass are proportionately on average 50 per cent higher than those of coal.27 Moreover, when the harmful long-term effects of modern wood and agricultural harvesting methods on the ability of soils to ‘store’ carbon are considered, the process may well be highly carbonnegative. In addition, current projections for biomass energy production, in addition, would require far greater volumes of agricultural and tree biomass than could ever be sustainably or equitably produced. Ironically, the EU ETS may be the cause of the further degradation of Europe’s and other countries’ soils and forests.

In many countries in the EU, the impact of having a feed-in tariff for renewable energy (where small-scale electricity generators are paid to produce their own electricity) has done far more to increase investment in lowcarbon energy and technology than the EU ETS. Most importantly, in order to remain within a global 1.5 degree temperature rise limit, the EU must above all reduce its overall consumption of energy, not just convert to renewables. Large-scale renewable energy production is not the same as sustainable energy production. Therefore, it is most important and urgent that the EU actually reduces its consumption of energy.

Myth 3

“The EU ETS is a system that is functioning as intended, and it is flexible”

Reality: The EU ETS is a cumbersome, unresponsive mechanism

For a supposedly flexible approach, the EU ETS has proven to be unresponsive and inflexible. It is a problem of trying to fit a square peg in a round hole. This is an atypical market in which the ‘commodity’ being traded is an abstract concept: a permission to pollute, making it also a speculative asset in the financial markets. The level of permit supply is set by using a combination of estimates and political negotiation: the number of permits issued is based on estimates of previous emissions, projections of future demand, and hard lobbying by industry.

It is therefore surprising to describe the EU ETS as flexible when it contains no means of adjusting supply once it proves to be lower (or higher) than predicted. This is best explained by Mark Lewis and Isabelle Curien, Deutsche Bank energy analysts:

“The EU ETS is the only commodity market in the world where demand varies in real time but supply is fixed years in advance…Without a mechanism that is more responsive to variations in demand in the carbon market, power companies will not be sufficiently confident in the EU ETS, which could lead to a rise in reliance on natural gas in the EU over the second half of this decade.”28

Interestingly, these financial analysts believe such a risk is present “even if a significant set-aside is agreed upon.” The result of fixed supply and falling demand is, of course, as we have witnessed, massive price crashes, and a lack of support for renewable energy investment. Whereas direct regulation could deal with these much more quickly (as the example of feed-in tariffs has shown), whereas markets are much less reactive, and politicians are far less ready to intervene quickly when required. This is a problem to do with the fundamental characteristics of the EU ETS and a key reason why the EU ETS cannot simply be reformed but must be replaced. The options for structural reform put on the table by the European Commission, be they discretionary price mechanisms (Option f); retiring allowances permanently (Option b); extending the EU ETS to other sectors with the intention of increasing demand (Option d); or limiting access to international credits (Option e), will simply be inadequate to achieve a functioning market, let alone transform the EU ETS into a tool that enables the EU to sustainably reduce its emissions.29

For this reason, the authors of this report call for a complete overhaul of climate policy in the EU, which means an end to the EU ETS and replacement with more responsive and effective policies as part of greater ambition to tackle climate change.30

Myth 4

“The EU ETS is delivering cost-effective emissions reductions” (Connie Hedegaard, EU Climate Commissioner)

Reality: The EU ETS has not been cost-effective for either the public or consumers

“Right now, in Europe we protect the climate by the most expensive and inefficient means possible”

CEO of E.ON, Johannes Teyssen.31

The EU ETS contains many hidden costs that accrue to the public, while generating a very poor income stream for Member States. Permits were initially handed out free, and carbon prices are now so low that subsequent auctions cannot hope to generate the revenue once envisaged. Meanwhile, the public must cover the cost of legislation and regulation for the markets as well as the cost of law enforcement to pursue fraud, theft, corruption, and tax and revenue-evasion scams conducted through carbon markets.

Box 3 NER300 reserve revenue to subsidise coal powerFrom 2013, most of the EU energy sector will have to pay for their EU ETS permits, and power producers will continue to pass through the cost of permits to consumers in the form of increased tariffs. Despite this, the industry, represented through the Union of Electricity Industry (EURELECTRIC), has demanded that they be compensated for the costs. They argued that the revenue from the auctioning of permits should be earmarked for Carbon Capture and Storage (CCS) projects. CCS is a technological process that traps CO2 emitted from industrial sources, particularly power plants, by compressing the gas into liquid then pumping it through pipes to a location underground, where it can theoretically be safely and permanently stored. However, there are significant technological and economic challenges in both elements of CCS – both capture and storage – that have not been resolved.32 So, with the help of an umbrella group called Zero Emissions Platform, which represents among others, utilities and petroleum companies and serves as an advisor to the EC on the research, demonstration and deployment of CCS,33 a new measure known as the NER300 was created. The revenue from the auction of 300 million permits from the New Entrants Reserve (for new companies joining the EU ETS) will be reserved in Phase III for so-called ‘clean energy’ projects, which include CCS and agrofuels, both of which have highly questionable environmental credentials.34 This revenue stream represents a major new subsidy, in the order of billions of Euros, for energy companies — not to fund the transition to low-carbon technologies, but to pay for a fix that will allow coal and oil plants to continue to operate. As Luxembourg Green MEP Claude Turmes remarked:

|

The cost-effectiveness argument is particularly weak when the windfall profits received by polluting industriesare taken into account. In all three phases of the EU ETS, carbon ‘costs’, that in reality were never incurred by the businesses in the first place, have been passed on to consumers.36 Research by CE Delft estimates that almost all of the supposed ‘cost’ of the permits given for free to steel and iron factories and refineries were passed through to consumers, and suggests that the windfall profits accrued from passing through these ‘costs’ reached EUR 1 billion between 2005 and 2008.37 The same circumstances were seen in the cement sector, since it was also able to pass the ‘costs’ to consumers.38 This has created “a purely regulatory windfall [...] it’s not fair to make money on a financial asset given for free,” according to Per Lekander, analyst at UBS AG, Paris.39

Changes in EU rules governing the uses of state aid mean public money is being used to pay back industry for a potential increase in operation costs due to the fact that permits from power installations are now fully auctionable. Member States are now free to return the monies received from permit auctions to the most polluting sectors, in the form of subsidies to ‘compensate’ industry for higher electricity bills (see box 3). Germany has already said it will pay its heavy industry up to EUR 500 million. For other countries, this will cause an imbalance in the EU market that they cannot afford to correct. The Netherlands, alongside seven other nations, claims that not all nations will be able to afford to make the payments, leading to “total market distortion” and “different CO2 costs for different companies” depending on which Member State they operate in.40

Again, at the point when cap-and-trade should at least be aiming to find the ‘real’ cost of pollution, and make the polluter pay, the system is rigged so that the heaviest, most polluting industries get off scot-free. But there will be no such subsidies for smaller industries, truly green initiatives, or domestic consumers, who are required to pay the full price for their electricity, including the cost of permits, even when these are given for free to industrial polluters.

Direct regulatory tools are often more efficient and effective than market mechanisms. One example is the UK’s Small Emitter and Hospital Opt-out Scheme.41 There are enormous administrative overheads incurred when participating in carbon markets. While a larger emitter must spend approximately EUR 0.04 measuring each tonne of CO2 equivalent, the figure can be over EUR 1 per tonne for smaller players. A group of 244 small emitters and hospitals in the UK have therefore opted out of the EU ETS and now participate in the UK’s Small Emitter and Hospital Opt-out Scheme instead.42 Installations that have opted out are given an individual emissions reduction target and face a penalty if annual emissions exceed the target. The Department of Energy and Climate Change has said that the savings offered under the scheme include the replacement of the requirement to surrender allowances with an emission reduction target, simplified monitoring, reporting and verification, as well as the removal of the requirement to hold a registry account.

Myth 5

“The positive thing is that the ETS is working well”

Reality: The EU ETS is a fraudsters’ paradise

All commodity markets contain some illegal activity, but certain key features of the carbon markets make them particularly susceptible to fraud. The EU ETS has been hit by a number of frauds and scandals, perhaps the most prominent of which is tax fraud. In 2010, a vast ‘carousel fraud’ in the EU ETS was exposed, involving up to EUR 5 billion.43 Criminal traders had repeatedly imported and exported carbon credits between different EU member state jurisdictions, to take advantage of the differences in levels of value added tax (VAT), before disappearing with the money that should have been paid to the revenue authorities.

The problems faced by the EU ETS in relation to fraudulent activity are yet another inherent weakness within any emissions trading systems that will forever leave it wide open to financial crimes. One key reason is the nature of the ‘commodity’ being traded. Carbon, unlike corn or oil, is not a tangible product. It is commoditised as a ‘permission to pollute in the future’ (permit); or ‘promise that pollution will not happen’ (credit). In some ways these transactions resemble the medieval sale of indulgences more than a modern commodity trade. For both permits and credits, the measurement of whether the pollution has or hasn’t occurred is estimated by proxy measures and other unsatisfactory methodologies. This is not something that can be reformed, and therefore poses a significant threat to the long-term reputational standing of DG CLIMA, something they are rightly concerned about, as expressed in DG Clima ’s 2010 and 2011 Annual reports.44

Further discrediting the EU ETS is the issue of ‘doublecounting’ permits ie recycling permits back into the system even after they have already been ‘used’. This is symptomatic of a fraudulent market, leading to an over-supply, and making it even harder to estimate reductions. Once a carbon credit has been used to supposedly offset a tonne of CO2e emissions, it should become null and void, and be cancelled, but recently EUR 5.7 million-worth of used credits were resold into the market.45 Trading exchanges were forced to close and trading company Total Global Steel went into liquidation, as companies tried to unravel the trail of purchases, and reclaim what they had paid for the now worthless credits.46

In fact, the biggest area of potential fraud is not in criminal attempts to game the system. It is systemic, hardwired into the processes by which permits and credits are created and used. The entire system is predicated on estimates, proxy measure and extrapolations. No polluter has the technology to accurately measure the amount of greenhouse gases they are emitting. The figure is arrived at via proxy measures: eg levels of production, or quantity and quality of coal purchased. It would be naïve to think that companies will not be looking to their bottom line when providing the information for these proxy measures, massaging the figures to ensure they have to hand over the minimum possible permits for their emissions.

Whether additional carbon releases are prevented by Clean Development Mechanism (CDM) projects is even more questionable. Estimates have to be made of the carbon footprint of a project or activity and then compared with an estimate of the carbon that would have been released if the project did not go ahead. The net carbon saving is known as the project’s ‘additionality’. It is impossible for offset projects to prove the required ‘additionality’, meaning that the problem is not that the tools for regulating the offset market are not working but the problem is that no such tools exist. Such offsets in fact create additional profit for many environmentally destructive projects.

Conclusion

Climate change is already occurring, and the EU is at the forefront of global calls to tackle global warming. But what the EU describes as its ‘cornerstone tool’ is an instrument that has proven to fail by its own standards and has blocked or undermined more direct, ambitious, and socially just policies. A group of 125 civil society organisations that have signed a declaration to scrap the EU ETS believes that the EU needs to be putting its resources into facilitating a direct transition to low-carbon economies, not developing a tool to guesstimate a price of carbon which benefits the biggest polluters.47 Real climate action and the EU ETS are not one and the same. Dropping the EU ETS after 2020 does not imply giving up on policies to address the climate crisis, or the need to find a replacement that really works. On the contrary, losing the EU ETS would reveal just how far the EU is from achieving just and democratic climate policies.

For the EU to achieve its legally mandated reduction targets of 80–95 per cent by 2050, it must start considering better and more effective options. Insisting on trying to ‘fix’ the EU ETS, broken from the start, diverts attention and resources away from these other policies. Policy instruments that have been shown to work, such as feed-in tariffs, redirecting public subsidies away from the fossil-fuel industry and towards low-carbon infrastructure, reducing consumption of energy, and improving energy efficiency, must be prioritised.

List of signatories

Alianca Redes de Cooperacao Comunitaria Sem Fronteiros Asociacion Ambiente y Sociedad, (Colombia), All India Forum of Forest Movements -AIFFM (India), ANPED, ATALC – Amigos de la Tierra América Latina y Caribe, Both ENDS (Netherlands), Carbon Trade Watch, CENSAT Agua Viva – Amigos de la Tierra Colombia, Centre for Civil Society (South Africa), COECOCEIBA – Amigos de la Tierra Costa Rica, Corner House, Corporate Europe Observatory, CounterBalance, Earth Peoples, Ecologistas en Acción (Spain), FERN, Food and Water Watch Europe, Friends of Siberian Forests (Russia), FASE, Friends of the Earth Brazil, Friends of the Earth Canada, Global Forest Coalition, Green Cross Society, Indian Social Action Forum (India), JA!Justica Ambiental – Friends of the Earth Mozambique, Movimento Mulheres pela P@Z!, NESPON (India), New York Climate Action Group, Observatori del Deute en la Globalitzacio (Catalunya), Philippine Rural Reconstruction Movement, PIDHDD, Re:Common, REDES – Friends of the Earth Uruguay, SDE, School of Democratic Economics, Taller Ecologista, Timberwatch (South Africa), TNI, UKWIN, WISE, Woodland League, World Development Movement

- 1. http://europa.eu/rapid/press-release_SPEECH-11-527_en.htm

- 2. http://ec.europa.eu/clima/policies/ets/reform/docs/com_2012_652_en.pdf

- 3. See Myth 3

- 4. Ibid.

- 5. See blog piece written by the Environmental Defense Fund: http://blogs.edf.org/ climatetalks/2012/10/18/the-eu-emissions-trading-system-is-reducing-emissionssparking- low-carbon-innovation-and-growing-up-really/and the relevant report they relate to: http://www.edf.org/sites/default/files/EU_ETS_Lessons_Learned_Report_ EDF.pdf

- 6. http://ec.europa.eu/clima/policies/ets/index_en.htm

- 7. Hans Bergman, Head of the Benchmarking Unit in the European Commission’s DG Climate Action at Friends of Europe event, 20th March 2013. See: http://www. friendsofeurope.org/Contentnavigation/Events/Eventsoverview/tabid/1187/ EventType/EventView/EventId/1204/EventDateID/1207/PageID/6381/ EUEmissionsTradingSystemThechallengeofrestoringcredibility.aspx

- 8. European Commission (2012) “Emissions trading: annual compliance round-up shows declining emissions in 2011 ”

- 9. Bergman, 2013. Ibid.

- 10. These countries are Brazil, Chile, China, Colombia, Costa Rica, India, Indonesia, Jordan, Mexico, Morocco, Peru, South Africa, Thailand, Turkey, Ukraine and Vietnam. http://www.thepmr.org/content/about-pmr

- 11. http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2011:0363:FIN:...

- 12. http://www.ersnet.org/eu-affairs/item/4636-43-billion-the-health-cost-of...

- 13. The EU agreed to reduce emissions by eight percent below 1990 levels for the first commitment period of the Kyoto Protocol (2008-2012). This target was translated into differentiated national emissions targets for each Member State. Besides the sectors covered under the EU ETS, each Member State is responsible for their Kyoto targets, which include other sectors: transport, agriculture (land use), waste, residential, commercial and institutional, and fluorinated gasses. See: http://ec.europa.eu/clima/ policies/ets/index_en.htm

- 14. Davis, Steven and Caldeira, Ken (2010) “Consumption-based accounting of CO2 emissions”, PNAS, 107(12), pp. 5687–5692 www.eea.europa.eu/publications/ technical_report_2002_75. See also Friends of the Earth Europe (2011) ‘Europe’s land import dependency’ http://www. foeeurope.org/publications/2011/Briefing_Europe_Global_Land_Demand_Oct11.pdf

- 15. Sandbag (2012) Help or Hindrance? Offsetting in the EU ETS http://www.sandbag.org.uk/reports/

- 16. http://www.carbontradewatch.org/downloads/publications/ETS_briefing_apri...

- 17. http://www.endseurope.com/31092/uk-airlines-to-gain-4767m-from-ets-derog...

- 18. http://europa.eu/rapid/press-release_SPEECH-11-527_en.htm

- 19. See data taken from Eurostat available at (www) http://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=sts_inprgr_a&lan...

- 20. European Environmental Agency (2011) Greenhouse gas emission trends and projections in Europe 2011: Tracking progress towards Kyoto and 2020 targets”, Copenhagen: EEA, p.37.

- 21. Sandbag (2009). ‘ETS SOS : Why the flagship ‘EU Emissions Trading Policy’ needs rescuing’ http://www.sandbag.org.uk/site_media/pdfs/reports/Sandbag_ETS_SOS_Report...

- 22. European Commission (2007) “Emissions trading: strong compliance in 2006, emissions decoupled from economic growth”, Press Release IP/07/776; European Commission (2008) “Emissions trading: 2007 verified emissions from EU ETS businesses”, Press Release IP/08/787.

- 23. For more information see: http://www.guardian.co.uk/environment/2012/oct/29/coal-threatens-climate...

- 24. Ibid.

- 25. Calel, R. and Dechezlepretre, A. (2013) ‘Environmental Policy and Directed Technological Change: Evidence from the European carbon market’, p. 4 http://www.endseurope.com/docs/130208d.pdf

- 26. See http://www.southernenvironment.org/uploads/publications/biomass-carbonst.... pdf in http://www.carbontradewatch.org/downloads/publications/ NothingNeutralHere.pdf

- 27. http://massenvironmentalenergy.org/docs/MEEA

- 28. http://www.platts.com/RSSFeedDetailedNews/RSSFeed/ElectricPower/8173110

- 29. For a full list of the reforms proposed by the European Commission see COM(2012) 652 final

- 30. See the contribution made by the “Scrap the ETS coalition” to the European Commission’s consultation on structural reform options for the EU ETS. http://scrap-the-euets.makenoise.org/input-consultation-ets/

- 31. http://www.eurelectric.org/media/50465/Teyssen.pdf

- 32. https://www.cbd.int/doc/emerging-issues/etcgroup-geopiracy-2011-013-en.pdf

- 33. http://www.zeroemissionsplatform.eu/

- 34. For problems with agrofuels, see: http://www.foe.co.uk/resource/briefings/agrofuels_fuelling_or_fool.pdf. For problems with CCS, see http://www.clientearth.org/climate-and-energy/carbon-capture-storage/

- 35. http://www.stopclimatechange.net/index.php?id=26&tx_ttnews%5Bswords%5D=r...

- 36. http://www.endseurope.com/31092/uk-airlines-to-gain-4767m-from-ets-derog...

- 37. http://www.ce.nl/publicatie/does_the_energy_intensive_industry_obtain_ windfall_profits_through_the_eu_ets/10

- 38. http://www.sandbag.org.uk/site_media/pdfs/reports/Sandbag_2011-06_fatcat...

- 39. http://www.steelworld.com/newsletter/apr12/newsroundupgl0412.html

- 40. http://www.ideacarbon.com/cra/News/index.htm/22May12

- 41. http://www.argusmedia.com/pages/NewsBody.aspx?id=809228&menu=yes

- 42. http://www.argusmedia.com/pages/NewsBody.aspx?id=809228&menu=yes

- 43. https://www.europol.europa.eu/content/press/carbon-credit-fraud-causes-m...

- 44. See CLIMA_AAR_2010_ final and Clima_aar_2011_final

- 45. http://www.nera.com/66_7735.htm

- 46. http://www.reuters.com/article/2012/08/13/us-cer-idUSBRE87C0BQ20120813

- 47. http://scrap-the-euets.makenoise.org/