Stay always informed

Interested in our articles? Get the latest information and analysis straight to your email. Sign up for our newsletter.

The European Commission has hired consultants who work for some of the biggest monopolies in the world to evaluate its merger enforcement policies. Enquiries made by Corporate Europe Observatory and LobbyControl show that the European Commission has barely explored if there is a conflict of interest in such an appointment, ignoring the EU Ombudsman’s recommendations.

A little-known economic consultancy firm has been hired by the European Commission to evaluate its merger rules. This is a stunning conflict of interest. RBB Economics works for some of the largest corporations in the world to push through mergers and acquisitions. The company was involved in many of the most controversial high profile mergers in recent history. Also, RBB Economics has for years lobbied in favour of weak enforcement of the EU’s merger rules, and against key provisions of the Digital Markets Act, which aims to rein in Big Tech’s monopoly power. Sidenote There are several economic consultancy firms which dominate the world of competition economics: Charles River Associates, RBB Economics, Compass Lexecon and Oxera. As outlined in an earlier publication from CEO and LobbyControl these firms have lobbied for weak enforcement of the EU's merger rules and enjoy a regular revolving door with DG Competition Sidenote

This is not a new phenomenon. For many years the European Commission has hired consultancy firms to undertake investigations and analysis in policy areas that they have a direct or indirect financial stake in. Just a few years ago, the Commission hired BlackRock, the biggest asset manager in the world, which has major investments in fossil fuel companies, to advise on policies on sustainable investments. This prompted the European Ombudsman to demand a revision of the Commission’s conflict of interests rules when issuing tenders. However, that only happened in August 2022, well after RBB Economics was awarded the contract. Furthermore, there are doubts whether the new rules are robust enough.

RBB Economics has for years lobbied in favour of weak enforcement of the EU’s merger rules, and against key provisions of the Digital Markets Act, which aims to rein in Big Tech’s monopoly power.

Review of merger policy at crucial moment in time

The European Commission’s evaluation of its merger rules comes at a crucial moment. Decades of lax merger enforcement policies have led to ever more market concentration. Studies have shown that extreme market concentration has led to increased income inequality, weakened labour rights, higher prices for consumers and has undermined democracy.

Numbers from the European Commission show that between 1990 and 2021 only 30 out of 8083 notified mergers were blocked by the EU, a mere 0.37 percent.

In no other sector is this more obvious than in the tech sector. Apple, Microsoft, Alphabet and Amazon are all in the top 5 largest companies in the world by market capitalization. Big Tech has used its dominance to acquire any potential competitors that might threaten this status. Meanwhile regulators have barely intervened to block any of these mergers. According to the former Chief Economist at DG Competition Tommaso Valletti, Big Tech has acquired more than 1,000 firms worldwide in the last 20 years. Of the mergers examined by the Commission, not one was blocked.

Numbers from the European Commission show that between 1990 and 2021 only 30 out of 8083 notified mergers were blocked by the EU, a mere 0.37 percent. A study commissioned by Corporate Europe Observatory moreover shows that the European Commission approved 9 out of 10 notified mergers without any conditions.

However, with the recently approved Digital Markets Act (DMA) Big Tech market power has come under more public and regulatory scrutiny in Europe. Moreover, in 2021 the Commission started a broad review of its competition policy, with one main objective being tackling the harm caused by digital monopolies. But key issues which will decide the effectiveness of these rules are still open, and these are a target for continued lobbying from Big Tech and its allies.

RBB Economics, the fox guarding the hen house

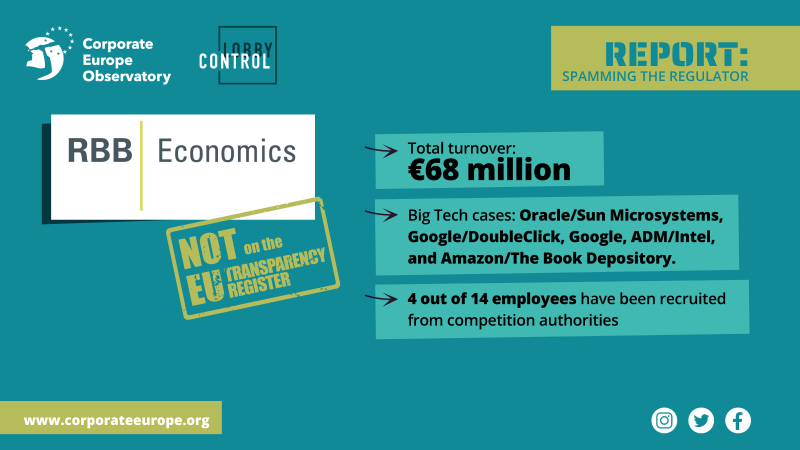

RBB Economics is an economic consultancy firm specialising in competition law, which represents clients from "all areas of industry and commerce as well as with all of the major law firms". RBB Economics represents these clients in EU merger and acquisition proceedings, and acts on behalf of them in the case of court proceedings and antitrust investigations. According to its own website RBB Economics has been involved "in hundreds of the most high-profile competition cases around the world".

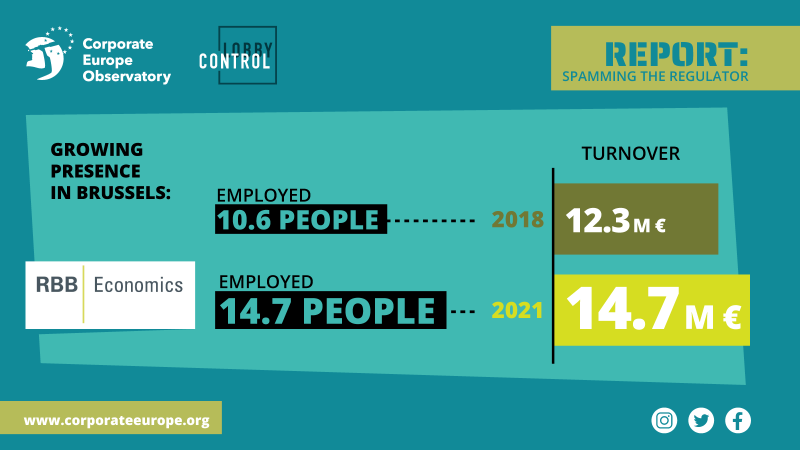

The presence of competition consultancies in Brussels like RBB Economics has grown substantially. The combined EU turnover of RBB Economics, Compass Lexecon and Charles River Associates (similar competition consultancy companies) increased from €27.9 million in 2018 to €34.6 million in 2021. The role these consultancy firms play in, and the influence they may have over, the EU’s competition policy has however largely been unaddressed.

In 2021 the Commission issued a tender for an evaluation of its merger enforcement policies, specifically to examine the way the Commission evaluates future market developments, including the entry and expansion of potential competitors and import substitution (see box). This issue is closely related to monopoly power. The more concentrated a market is, the more difficult it is for potential competitors to enter that market.

The policy advise the Commission outsourced to Big Tech's best friend

In June 2021 the European Commission issued a tender for the study "Commission Assessment of Future Market Entry, Expansion and Imports in EU Merger Decisions", which was subsequently awarded to RBB.

The study aims to formulate policy conclusions and recommendations in order to improve the enforcement practices of the European Commission in merger controls. The study will look specifically at how future market developments such as entry, expansion and import substitution figure in the EU’s merger assessments, and will assess if the Commission’s approach has been too strict or too lenient. The study cannot be seen separately from the Commission’s review of its competition policy, which foresees an assessment of its analytical tools.

While the above might sound technical, it is in fact a question which has become increasingly central to merger enforcement, with the rise of the digital economy. Due to network effects, the tech sector is rife with monopolies, with extremely high barriers to entry for new competitors. The more people use a website, app or social network, the more others will be likely to use it as well, and the ‘better’ the data these companies will have, which in turn is used to feed the algorithms of these platforms. In addition, tech companies have used their position to buy any potential competitors, so as to further entrench their monopoly power or to enter new markets in order to expand their web of data-driven platforms, and to avoid competition.

As the Dutch Centre for Research on Multinational Corporations (SOMO) stated in a report; “the Big Tech model essentially revolves around creating, maximising and monetising network effects”. Venture capitalists pour billions of funding into unprofitable tech companies, hoping that they will one day attain a monopoly position and return the investment. Uber is infamous for never having made a profit, losing $9 billion in 2022 alone, but nevertheless becoming bigger every year in terms of revenue. As Peter Thiel, venture capitalist and co-founder of the tech companies PayPal and Palantir, wrote in 2014: “Competition is for losers. If you want to create and capture lasting value, look to build a monopoly.”

The study tender awarded to RBB includes the examination of 15-25 case studies of borderline and significant merger cases in order to assess if the projections made by the European Commission at the time of making decisions on whether the mergers could go ahead actually played out in reality. RBB clearly has a financial interest to steer the study and the policy recommendations attached to that study in a direction that is beneficial to its own future work, and that of its clients. This obviously makes it an unsuitable candidate to undertake this research task, given its clear conflict of interest.

In a context where market concentration and monopoly power are finally being questioned by regulators, it is especially alarming that a crucial aspect of that agenda is now being outsourced to a consultancy company which has a long track record of defending companies with monopoly interests.

"Competition is for losers. If you want to create and capture lasting value, look to build a monopoly." - Peter Thiel, venture capitalist

LobbyControl and Corporate Europe Observatory put this question directly to DG Competition. “Do you consider it a potential conflict of interest if an economic consultancy evaluates DG Competition on merger decisions and at the same advises clients on EU merger cases?” The Commission’s reply indicated that it had no legal basis to exclude economic consultancy firms a priori that “are currently advising clients on ongoing EU merger cases from participating in tenders for ex post evaluation studies”.

This response is questionable, however. RBB Economics not only has a clear financial interest in shaping the EU’s merger enforcement policies in the interest of its clients, it has also lobbied the EU directly to influence these same policies.

RBB Economics – Big Tech’s favourite consultant

RBB Economics has provided expertise to support some of the biggest mergers in the last couple of years. These include tech clients such as Google, Oracle, Qualcomm and Booking.com, but the company has also assisted mergers in almost every economic sector. The financial stakes are often enormous. The Dow/Dupont $130 billion merger for example (see below) was one of the biggest mergers of the past decade (see the list of cases RBB Economics has been involved in at the bottom of the article). Sidenote This list is based on cases mentioned on https://www.rbbecon.com/news/ and the cases RBB employees worked on during their time at RBB as shown on their CVs. Sidenote

RBB Economics has a longstanding commercial relationship with Google. It assisted Google in pushing the DoubleClick merger through with the European Commission in 2008, a merger which was ‘credited’ as being key to Google’s rapid expansion in surveillance advertising. Ironically, only 13 years after this approval, the European Commission opened a formal antitrust investigation into Google’s adtech business. This controversial area of Google’s business is a direct legacy of the company’s acquisition of DoubleClick, the consequences of which have prompted calls to rethink merger enforcement policies.

Google’s abuse of its dominant market position has increasingly come under fire from the European Commission and other regulators. In 2017, 2018 and 2019 the Commission imposed three fines totaling almost €8.2 billion on the company, for anti-competitive behavior and abuse of its dominant position. RBB Economics is involved in all three cases on behalf of Google. Sidenote These cases include the Google Shopping fine of €2.4 billion, the Google Android fine of €4.3 billion and the Google AdSense fine of €1.49 billion. Appeals against all three of these fines are still pending at the EU General Court or the EU Court of Justice. Antitrust investigation against Google AdTech and the so-called ‘Jedi Blue’ agreement between Google and Meta are still ongoing. Sidenote

The largest of these investigations, which imposed a fine of €4.3 billion - the largest ever anti-trust fine - found that Google used its Android system to illegally push smartphone and telecom operators to use Google search and exclude other search engines. In a press release the Commission stated that “Google has used Android as a vehicle to cement the dominance of its search engine.”

Google’s search engine is crucial to its business model, which is based on massive data collection that in turn fuels its online ad business. By tying the hands of smartphone producers through its Android ecosystem, Google successfully and illegally expanded its business model from PCs to smartphones. The General Court of the EU has mostly upheld the Commission’s fine, lowering it slightly to €4.1 billion. An appeal by Google is still pending with the European Court of Justice.

These antitrust fines have however proved completely inadequate to stop Big Tech’s monopoly power. Often enough they seem to be seen as just another, relatively inconsequential, ‘cost of doing business’ for these companies. Even Commissioner Vestager admitted that the fines haven’t always had the effect hoped for. Following Apple’s refusal to comply with a decision of the Dutch Competition Authority, she stated that “as we understand it, Apple essentially prefers paying periodic fines”. The only structural solution is to break up these companies, a step the Commission refuses to take.

RBB: In the background on many controversial cases

RBB Economics has been particularly active in Big Tech cases, but this is not their only remit. In fact, RBB Economics has worked as a consultant in some of the biggest and most controversial cases dealt with by EU competition authorities in recent years (see box below).

Among the most contentious cases is the merger between German company Siemens and the French firm Alstom. Both companies manufacture railway equipment, and the merger aimed to create a European giant, capable of competing with the two Chinese companies with the biggest market share globally in the sector. However, the Commission rejected the merger, stating that the two companies showed no willingness to address “serious competition concerns”. That decision led to immense pressure from Germany and France, who called for reform of EU competition policy to allow more consideration for global competitiveness issues, rather than just the impact on the EU market.

RBB Economics has worked as a consultant in some of the biggest and most controversial cases dealt with by EU competition authorities in recent years.

RBB was on site too when the Commission considered a merger between two companies active in – among other areas – water supply. This is a very controversial area, given that two companies in the European Union are at the heart of a series of scandals following privatisation of water supply across the globe, and both are French: Veolia and Suéz. Handing over water supply to a private company inevitably introduces a profit focus that on too many occasions has led to high and increasing prices, poor maintenance and services, and ultimately to public outcry and even uprisings against water companies. The prospect of a merger was seen by civil society groups as a move that would consolidate corporate control of water. Despite these concerns, the Commission approved the merger, although the deal included divestment from certain activities such as hazardous waste management.

In the area of inputs for agricultural production, a massive market concentration took place in 2017-2018, due to three large mergers: the Bayer/Monsanto merger, the acquisition of Syngenta by the Chinese company ChemChina, and the merger between Dow and Dupont. In Europe, RBB Economics worked on behalf of Dow and Dupont to get their merger approved by the European Commission.

In the US, the National Farmers Union worked hard to convince US authorities to prevent the same merger: “The merger of Dow and DuPont, the 4th and 5th largest firms, would give the resulting company about 41% of the market for corn seeds and 38% of the market for soybean seeds,” said the NFU President Roger Johnson. “If the Dow-DuPont and Bayer-Monsanto mergers were both approved, there would effectively be a duopoly in the corn and soybean seed markets.”

In Europe too, opposition was widespread. A letter from 200 civil society organisations, predominantly environmental, but including many farmers groups, called on the Commission to reject all three of the agricultural mergers. Nevertheless, the Commission approved the deals.

It is clear, then, that RBB Economics is a heavyweight when it comes to merger cases in the EU, and has successfully secured approval from the Commission for many recent mergers. In fact, the company has worked on most of the biggest and most controversial cases in recent years (see box).

Lobbying to shape the EU’s merger policy

RBB Economics doesn’t only have a vested interest in merger enforcement policies on behalf of and due to its clients, it has also lobbied directly to shape the EU’s merger rules. It has participated in public consultations, published discussion and position papers and has organised conferences on the EU’s competition policy.

While these activities clearly fall under the remit of the transparency register as lobbying, RBB Economics is not registered on the lobby register. Corporate Europe Observatory and LobbyControl have therefore prepared a complaint to the transparency register’s secretariat, against RBB Economics and three other economic consultancies who have also not registered their lobby activities.

For example, in May 2021 RBB Economics was partner in a round table on the Digital Markets Act organised by Concurrences. Other partners included Apple and the law firm Skadden. At least one of the speakers at the event was an official from DG Competition. During the round table Benoît Durand, partner at RBB Economics, defended the monopoly power of the tech industry and complained that the Digital Markets Act (DMA) might end some of these business practices: “In these markets, concentration is natural.” Durand argued that a monopoly position should be seen as a reward for ‘risky investments’: “challengers would have to invest heavily, and for them to take this risk, they should expect to reap the fruits of their investment, which might mean that they should expect to earn some monopoly rent until they are also displaced themselves by new challengers.”

"In these markets, concentration is natural. [...] Companies should expect to earn some monopoly rent." Benoît Durand, RBB Economics

In another panel discussion in June 2022 Durand again argued that ‘self-preferencing’ by Big Tech was not a problem. Self-preferencing is the practice whereby Big Tech use their platform power to promote their own products, thereby reinforcing their own position and excluding competitors. The DMA prohibits gatekeepers from using their algorithms to self-preference. Still, Durand argued that “self-preferencing can also be seen as beneficial for consumers”.

RBB Economics has consistently lobbied for a limited and technocratic approach to competition policies. In a submission to a public consultation on the EU’s Market Definition Notice, RBB Economics strongly pushed for a theoretical tool called the Hypothetical Monopolist Test (HMT). “as the only valid conceptual framework” to define markets as this would impose more “discipline” on the Commission. The HMT test (also called a SSNIP test) defines a relevant market by assessing if a hypothetical monopolist can impose a "small but significant and nontransitory" increase in prices. This test has however been criticised for being opaque, for producing “purely arbitrary results” and for potentially being misused to justify overly broad markets (which benefits merging companies).

Moreover, there has been growing criticism of this technocratic approach to merger control, as it tends to benefit large corporations and the consultants working on behalf of them. The former chief economist of DG Competition Valetti said in an interview that “the [merger investigation] process has become crazy. [The Commission] must create a definition of the relevant market, then calculate market shares. This will often have little to do with reality. For example, with Facebook-Instagram, the outcome of the investigation into what is the relevant market was: Online Camera Apps!”

Cristina Caffarra from Keystone Strategy, a consultancy firm with multiple tech clients, and previously a senior consultant with Charles River Associates has also criticised this technocratic approach pushed by economic consultants saying that a “dubious legacy of the “more economic approach” has been oversold as “science” but in fact has weakened [merger] enforcement” […] Of course, economists have peddled these tests because they were working for defendants and the tests are deeply pro-defendant.”

Professional conflicting interest

The European Commission’s inclination to hire consultancy firms to undertake investigations and analysis in a policy area where they have a direct or indirect financial stake, is a phenomenon that goes back many years. Among previous examples, the Commission hired one of the four big consulting firms (Ernest & Young, PriceWaterhouseCoopers, Deloitte & Touche and KPMG) to analyse ways to make progress on tackling tax havens, while those very same firms advise companies on ways to avoid taxation. Another example is the hiring of a Danish based consultancy, Copenhagen Economics, by the Commission to investigate pricing of pharmaceutical products - the same company works for the pharmaceutical industry.

The problem is obviously that such consultancy firms can hardly be expected to advise the Commission to take action that would negatively impact their own clients. Such a clear conflict of interest as regards being able to genuinely deliver advisory work is covered by the term “professional conflicting interest”. When the Commission considers the submissions it receives to a public tender, it must “verify” whether such a conflict exists. Should the Commission conclude that a conflict does exist, they are required to reject the bidder (article 167.1c of the Financial Regulation).

The problem is obviously that such consultancy firms can hardly be expected to advise the Commission to take action that would negatively impact their own clients.

The Commission cannot possibly have considered the existence of a conflict of interest in a meaningful way in the case of RBB. RBB Economics has been contracted to undertake a study on an area in which it has a significant vested interest. The company has been party to many of the high profile cases in the past, advocating for the approval of significant mergers. Surely the company would have an interest in proving itself right, and in reiterating that the approval of certain mergers was justified. Also, the company would have a significant interest in advocating for and securing an approach to mergers in the future that would not restrict its clients into the future. Nonetheless, exchanges between DG COMP and LobbyControl showed no indication of an investigation into conflicts of interest in this case.

A major recent scandal: the BlackRock case

The RBB case comes in the wake of a major scandal that rocked the world of EU public tendering. It is still not known what the final outcome of this case will be, as the proposed changes to EU law that resulted from the fallout around this case have not been fully processed yet.

The case arose when the Commission picked the biggest asset management company in the world, BlackRock, to investigate how to make banking more sustainable. BlackRock was a consultant with at least two clear vested interests: First, BlackRock itself has a major stake in fossil fuels – oil, gas and coal. Second, the asset manager is a major shareholder in European banks - at the time, BlackRock was the biggest or second biggest shareholder in nine of the ten biggest banks in Europe.

This was not received well by the European Parliament. More than 30 MEPs signed a protest letter, and some joined a coalition of NGOs who complained to the European Ombudsman.

In November 2020, the Ombudsman published a remarkably strong decision. “The decision to award the contract to the company did not provide sufficient guarantees to exclude any legitimate doubt as to the risk of conflicts of interest that could negatively impact the performance of the contract.” Furthermore, the Ombudsman said that it was questionable for the Commission “to conclude that there were no legal grounds to exclude BlackRock Investment Management from the procurement procedure.”

Commission left procedures unchanged for 2 years

In conclusion, the Ombudsman suggested that clarification and change was necessary at two levels: rectification of the Commission’s internal rules guiding public tenders, and amendment of the Financial Regulation – the law that governs all expenditure by the EU institutions.

The Commission would follow up on the recommendations of the Ombudsman. In May 2022, it presented a series of amendments to the Financial Regulation, including proposals that would seemingly put public procurement of important consultancy work on a different track.

Concerning the recommendation to review the Commission’s internal rules, it was only in August 2022, almost two years after the Ombudsman's decision on the BlackRock case, that the Commission changed its internal rules. While they do strengthen procedures concerning 'professional conflicting interests', there are still doubts whether they ring in a new era where vested interests of a company in investigations relevant to policy making will rule them out as contractors to studies.

RBB case no less egregious

The RBB case is no less problematic than the BlackRock case. In fact, in at least one aspect it is actually worse. RBB Economics has worked as a consultant to merging companies for many years, and the advice it is now being contracted to give can impact future competition cases to be decided by the Commission. It is hardly plausible or credible that RBB would propose anything that would upset previous, existing or potential future clients.

Furthermore, there is another equally big problem built into the agreement with RBB Economics. Given the plethora of controversial cases that RBB Economics has worked on, the existing narrow definition applies to RBB Economics in one way that it did not in the BlackRock case. According to that definition, a company “should not evaluate a project in which it has participated.”

According to its correspondence with Corporate Europe Observatory and LobbyControl, the Commission did not a priori exclude case studies that RBB Economics has worked on. The Commission simply stated that the study concerns “decisions from the past only, which are not necessarily related to currently ongoing cases. Moreover when the contract for this study was tendered and awarded, the list of cases to be evaluated was not yet determined”.

Theoretically, the EC could ask RBB Economics to sidestep the evaluation of cases in which it was involved, but that would create another problem. Since the company was involved in so many high profile cases, including some of the most important ones for the hi-tech sector, an investigation that simply ignored those cases, would clearly make RBB Economics “professional conflicting interest” even more obvious and problematic.

The proper response to the RBB case

There is a serious risk that the final recommendations that come from the report that RBB will produce for the Commission will feed into the hands of the very corporations RBB Economics works for. And in the crucial case of regulating Big Tech, the specific and significant concerns that have received public and regulatory attention in recent years can hardly be addressed under circumstances where the most relevant cases are to be ignored in the review, due to RBB’s conflict of interest. These problems are all good reasons to drop RBB Economics as a consultant on such matters in general, and on mergers in particular.

To have any credibility in the future, the Commission must immediately end its tradition of hiring consultants with a strong vested interest.

To have any credibility in the future, the Commission must immediately end its tradition of hiring consultants with a strong vested interest, and chart a different path in assessing its past and future approach to mergers.

Also the European Parliament, which is at the moment negotiating the reform of the Financial Regulation, has a unique opportunity to make sure that consultancy firms with a vested interest are once and for all excluded from public tenders.

This article was edited in July 2023 to correct mistakes regarding the Commission's guidance on public procurement. Preliminary research had shown the guidance had not been changed following the BlackRock case, but that did happen in August 2022.

Member of the european Parliament Paul Tang states in a reaction: "It sounds like a parody. Companies lobbying the European Commission to water down its merger rules are asked to evaluate the Commission's EU's merger rules. It is astonishing independency was apparently not seen as a criterium."