Fuelling the cost of living crisis

How the fossil fuel industry turned the Ukraine war into an opportunity for extra profits and further lock-in of gas

How are oil and gas firms able to make record-breaking profits while millions struggle to pay their bills? A new investigation from Corporate Europe Observatory, l'Observatoire des Multinationales and Recommon, members of the Fossil Free Politics campaign, reveals that from the onset of the Ukraine war, European fossil fuel majors have enjoyed unprecedented access to EU leaders. Thanks to their oversized influence, and capitalising on divisions between EU leaders, they have been able to delay and minimise decisive political action on energy markets, which allowed them to rake in billions in profits. In the name of urgency, they also gained an even stronger role than before in EU decision-making on energy issues, pushing for ever more gas infrastructure and gas-based projects. As a result, we are locked in a spiral of skyrocketing energy prices, corporate profiteering, fossil fuel addiction and climate disaster.

This report finds:

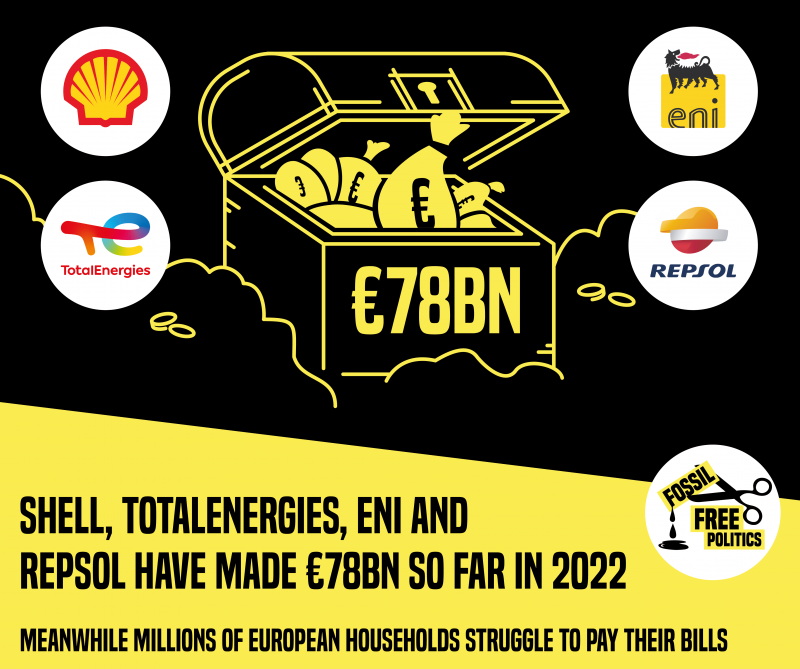

- €78bn in profits up to September 2022 for Shell, TotalEnergies, Eni and Repsol;

- More than 100 meetings between the fossil fuel industry and European Commission leaders since February - that’s one every other day;

- Commission President Von der Leyen met several times with oil and gas CEOs while formulating the bloc’s energy response to the Ukraine crisis, where it was warned against “fiddling” with the market and price caps, and advised on which measures were “feasible”;

- The fossil fuel industry has avoided having to foot the bill for an energy crisis of its making: lobbying to delay and weaken measures coincides with no significant political intervention in energy markets, such as ambitious windfall taxes or price caps, that would reduce their profits;

- The eventual EU “tax” on windfall profits of oil and gas corporations - rebranded as a “solidarity contribution” - looks increasingly like a symbolic measure, full of loopholes, that will not yield the announced billions of euros;

- In addition, the industry has successfully lobbied for massive public support for new gas infrastructure and gas-based technology developments: ENTSO-G proposes 300 new gas projects over the next ten years to respond to the ongoing “emergency”, which will keep up profits as well as people’s energy bills;

- At the request of industry, the EU has set up an ‘Energy Platform Industry Advisory Group’ exclusively made up of Europe’s major gas companies, with a mandate to effectively co-manage the Commission’s plans to get off Russian gas;

- EU and US oil and gas lobby groups have also been working with senior Members of the European Parliament (MEPs) to push for more domestic gas production and more imports;

- The fossil fuel industry in Italy and France also successfully lobbied for more support for fossil fuel infrastructure, while TotalEnergies avoided a windfall tax at national level.

Introduction

The spike in energy prices that followed the invasion of Ukraine and Western sanctions on Russia, coming on top of post-Covid difficulties, has cascaded into a full-scale cost of living crisis with millions of Europeans struggling to pay their energy bills and fears of shortages. Perversely, what should have been a belated wake-up call for European leaders about the dangers of their reliance on oil and gas, global energy markets, and corporate giants has turned into a further tightening of the noose of fossil fuel industry influence on EU decision-making.

As a result, European majors such as Shell, TotalEnergies, Eni, and Repsol continue to pile on profits, with an extra €24.6bn in the third quarter, coming on top of the €53.3bn of the first semester. Those total profits of €77.9bn for these four companies alone over the 9 first months of 2022 are double the €40bn proposed by the EU to mitigate the cost of energy crisis.1 It’s equivalent to €395 for every single European household - which if distributed among us would amount to a significant mitigation of rising energy prices.

Thanks to their privileged access to EU leaders, capitalising on divisions among member states, they’ve managed to delay and minimise any genuine political intervention that would have kept energy prices in check, and they’ve come out of the debate on the taxation of their windfall profits with minimal damage. Worse still: they've managed to use the crisis to their own advantage by forcing the EU into more infrastructure investments that will further lock in gas consumption and more public support to fossil fuel based false solutions. Yet the IPCC is very clear about the fact that we need to stop new oil and gas projects and initiate a rapid phase-out of fossil fuels if we want to keep global temperatures increase below 1.5°C. Not only will further gas infrastructure investment provide no real short-term solutions to rising energy bills and to the cost of living crisis, these projects are actually set to keep energy bills at high levels for years to come.

Raking in profits, wielding massive bargaining power, getting ever cosier with decision-makers, dodging accountability... We've seen it all before, with big banks following the 2008 financial crisis, and then during the Covid pandemic. As the first wave of Covid took its toll in the spring of 2020, European citizens woke up to the sorry state of public health systems and to our over-reliance on globalised markets and private operators to meet our basic needs. EU governments have shied away from giving up on their reliance on liberalised markets and multinational corporations.

In order to keep the economy afloat, they've pumped massive amounts of public money into financial markets and corporate coffers. They've also neglected, in their negotiations with pharmaceutical corporations such as Pfizer and AstraZeneca over Covid vaccines, to impose strong public interest conditions in their contracts or even to reduce their reliance on a handful of corporate giants. They basically submitted to their terms in the name of preserving market mechanisms, whatever the billions of euros it would cost, and that would ultimately be borne by European consumers and taxpayers.

In the energy sector too, the European Union has opted to give industry even more influence on decision-making in the name of emergency. So far, in spite of some gesturing by the Commission for many months that they were “studying” policy options such as price caps for gas and electricity, the EU has stubbornly refused to give up its blind faith in markets that were obviously failing. While the EU was refusing to act, energy prices continued skyrocketing in Europe and the rest of the world, while corporations enjoyed record profits.

This choice to leave the economic power and political influence of the oil and gas industry untouched may have been enough to secure enough gas and fill storage facilities to pass one winter, but in the long term, it has locked us in a spiral of skyrocketing energy prices, fossil fuel addiction and climate disaster.

Four of Europe's biggest oil and gas firms have made eye-watering profits in 2022

TotalEnergies

Profits since Jan 2022: €27,8bn

Lobbying budget: up to €2,25 million

Meetings with Commission (directly and through trade groups): 30

Shell

Profits since Jan 2022: €34,6 billion

Lobbying budget: up to €4,5 million

Meetings with Commission (directly and through trade groups): 34

Eni

Profits since Jan 2022: €10,8 billion

Lobbying budget: up to €1,5 million

Meetings with Commission (directly and through trade groups): 29

Repsol

Profits since Jan 2022: €4,7 billion

Lobbying budget: up to €700.000€

Meetings with Commission (directly and through trade groups): 20

In total, the four oil and gas giants have made €78 billion up to September this year - with three months still to go.

From the onset of the war, unprecedented access for the fossil fuel industry

The influence of the fossil fuel industry on Brussels decision-making is nothing new. European oil and gas majors and energy giants have always wielded considerable lobbying firepower in Brussels, and EU institutions have often proved more than happy to give them many seats at the table when it came to the bloc's energy policy or priority investments.

An analysis by Friends of the Earth Europe published in June 2022 showed that the von der Leyen Commission had met more than 500 times with the fossil fuel industry or with groups with fossil fuel membership in the first half of its 5 year mandate, between December 2019 and May 2022.2

The trend has only accelerated since the start of the Ukraine war. From the beginning of February 2022, when the signs of the upcoming invasion could not be ignored any more, until the end of September, the fossil fuel industry has had more than a hundred disclosed meetings (105) with the European Commission – more than one every other day. The Commission also had dozens of meetings with the petrochemical industry, another key player in global oil and gas markets – which includes oil and gas majors as well as corporations such as BASF or Dow and groups such as Cefic, the EU’s chemical industry lobby group.

Just as with the Covid crisis, under the pretext of “emergency”, an industry directly interested in EU policy decisions has been granted regular top-level access to EU leaders and invited to co-write EU policy. Transparency around these meetings has been unequal at best, with Commission officials refusing to disclose details about some meetings or claiming they had no record of them.3

Many issues were high on the agenda of EU authorities in the weeks and months following the Russian invasion of Ukraine - how to reduce Europe’s dependence on Russian gas, how to secure enough gas supply to pass the winter, windfall profits and their taxation, rising energy prices, price caps, energy market design, and many others. The fossil fuel industry’s privileged access made sure it had its voice heard on all these files and could shape EU decisions on them - or in many cases, EU indecisions.

Lobbying the Council and the European Parliament

- The fossil fuel industry did not only find open doors at the Commission. In its efforts to hinder political action on energy prices, it also targeted the European Parliament and the Council of the EU. For example, Romanian MEP Christian Busoi (EPP), chair of the powerful Industry, Research and Energy (ITRE) committee, organised an event with fossil fuel lobby group the International Association of Oil and Gas Producers (IOGP) in Strasbourg, to present a new study commissioned by the trade group and its US counterpart the American Petroleum Institute (API) on “Rebalancing Europe's gas supply”. The event, co-organised with fellow gas lobby groups, the European Network of Transmission System Operators for Gas (ENTSOG) and Gas Infrastructure Europe (GIE), was an occasion to advocate for strengthening Europe's gas transport system (in other words, more gas infrastructure) and for more domestic gas production in Europe.

- A similar lobbying offensive took place at the level of the European Council and member states, even though details are scarce because of the lack of transparency of the Council and of member state representations in Brussels.4 In the run-up to the country's Presidency of the Council (second semester of 2022), Czech representatives met with TotalEnergies at the end of March, around the same time the EU released its first version of RePowerEU laying out how it would get off Russian gas. No minutes of this meeting are available.5 The Czech Republic, currently holding the presidency of the Council, has ceased to publish the meetings of its permanent representative with lobbyists since June 2022, when its presidency began.6

The ERT: Guardians of the Market

The European Round Table for Industry (ERT), a highly influential CEO-level lobby group whose membership includes Shell, BP, TotalEnergies, and Eni, has played a key role in getting the fossil fuel industry’s message across to EU leaders. When Russia invaded Ukraine and the EU was faced with a new emergency, the ERT seems to have become the de facto co-ruler of European energy policy and of the flagship RePowerEU plan for getting off Russian gas.

Of the nine lobby meetings disclosed by Ursula von der Leyen since the start of the war, four were with the ERT and another with a group of energy and transport chief executives who were all ERT members - Siemens, Air Liquide, Maersk, and Volvo.

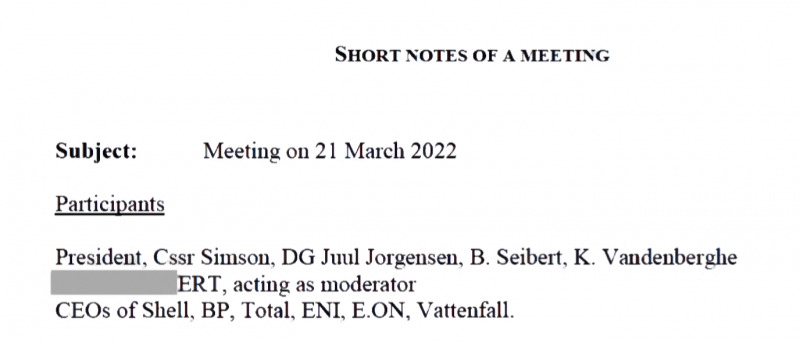

Four of these meetings took place in March, during the design of the RePowerEU, including two “with energy CEOs” – namely, those of Shell, BP, Eni, TotalEnergies, E.on and Vattenfall – two days before and on the very day the plan was publicly announced.

Von der Leyen has not updated her meetings calendar since July, but we know she met the ERT again at least one time, on 25 October in Berlin.7

Good discussion between @vonderleyen and ERT Chair Jean-François van Boxmeer in Berlin today.

— European Round Table (@ert_eu) October 25, 2022

Many important challenges ahead for #skills, #competitiveness and rebuilding Ukraine. #SlavaUkrainii pic.twitter.com/FxXH4WPCb1

During these meetings, the ERT and fossil fuel CEOs cautioned the Commission against “fiddling with market mechanisms”, warning it could have “unintended consequences”.8 They also cautioned them against introducing a price cap, which they deemed “problematic”.9

The ERT, founded in the 1980s, has been a major player in Brussels over the years. Alongside the Commission, It has been the main driver of single market integration and liberalisation across the EU. The ERT has come back to the centre-stage under Ursula von der Leyen's Commission.

“I discussed with energy CEOs and [the ERT] how to diversify supply and reduce demand for gas. We will set a group of industry experts to help reduce our dependency”

Ursula Von der Leyen

During the Covid pandemic, Commission President Ursula von der Leyen began meeting regularly with the CEOs of large European corporations Siemens, Air Liquide, Maersk, and Volvo, under the auspices of the ERT, to discuss recovery and the needs of the European industry - still focussing on reinforcing the single market as the single response to the continent’s economic and social woes.

Effectively, the ERT saw the energy price crisis not as an illustration of the flaws of liberalised energy markets, but as an opportunity to further extend and consolidate them. “Now is the moment for a true European hydrogen market and cross-border interconnectors”, they told Ursula von der Leyen, Emmanuel Macron, Olaf Scholz, and other EU leaders during a meeting in Paris.10 This meant, as we shall see further, more gas infrastructure for an even more integrated Europe-wide gas market, and promoting hydrogen as a way to further expand this market by adding gas-based or renewables-based hydrogen from various sources, particularly North Africa.11

Delaying tactics

The ERT’s message was reinforced by Conseil de coopération économique (CCE), a secretive “think tank” funded by industrialists and governments from Southern Europe. CCE met with Von der Leyen advisers in early May arguing that the rising electricity prices were “not a consequence of the electricity market dysfunctionality”, but on the contrary of “a well-functioning electricity market” that reflected “a global supply and demand imbalance of natural gas”.

CCE claimed any willingness to cap energy prices would be counterproductive: “The market is working properly: it is reflecting a tight supply situation. Reducing the market price translates into higher demand, ie market interventions are counterproductive”.12 This echoed the view of the EU Agency for the Cooperation of Energy Regulators (ACER), another market fundamentalist who claimed in late April that “the current electricity market design is not to blame for the current crisis.”13

European consumers and small businesses would probably beg to differ from this notion of a “well-functioning market”, as they are faced with skyrocketing prices, which are the result of geopolitical decisions and cartels such as OPEC, and benefit global corporations and handful of oil-producing countries while everybody else bears the brunt of the increase. And it is all the more ironic since at the same time, those believers in the “free market” are asking for massive public support for infrastructure and technology development.

CCE also argued that any sort of political intervention on energy markets would hurt both Europe's short term security of supply and long-term investments in climate transition, as it would spook off investors: “Market intervention, including claw-back mechanisms, proposed by various national governments in the EU are a major concern and put at risk much needed regulatory stability for long-term investments in the green energy transition. These measures negatively impact investor confidence, damage market functioning (including cross-border trade), reduce security of supply and hinder a cost-effective transition to a carbon neutral economy.”

All these warnings about potential unintended consequences were classic delaying tactics. The “proposal lacks the usual impact assessment”, argued CCE. “We cannot address a short-term situation with measures having an impact in the long term without a pertinent analysis”.14

In June, Commission President Von der Leyen eventually admitted to Parliament that “This market system does not work anymore. We have to reform it.”15 Yet after holding numerous meetings, toying with different policy solutions, considering many options, the EU did almost nothing to reduce energy prices. Proposals to cap gas electricity prices have been pushed by some governments from the very beginning of the Ukraine crisis and were actually implemented in countries such as Portugal and Spain, but effective decisions were always delayed. European leaders were divided, some fearing that any action to change the rules of the market would spook Europe’s foreign gas suppliers. Fossil fuel corporations only had to play on those divisions to prevent decisive action.

Leave our “super-profits” alone

Indeed, as the EU rushed to buy as much gas as possible – in the name of emergency - while refusing – in spite of the emergency – to interfere whatsoever in market mechanisms, energy prices began going up and profits began to flow into the pockets of major oil and gas corporations. By the end of July, Shell had announced a half year profit of around €25bn, TotalEnergies €18bn, Eni €7bn and Repsol €3.2bn. A hefty total of more than €53.3bn for the first half of the year.

Even though fears of recession and the fact that EU countries are reaching maximal storage capacity for the winter have contributed to a short-term easing of energy prices, oil and gas majors are continuing to cash in. In the third quarter, Shell added an extra €9.5bn in profits, and TotalEnergies €9.9bn. Repsol declared a profit of €1.5bn, while Eni €3.7bn. That's a total of €77.9bn in the first nine months of 2022.

Inevitably, these announcements led to renewed calls for intervention on energy markets or at least for a taxation of the windfall profits of the fossil fuel industry. The massive profits announced by energy corporations were all the more sensitive an issue, given that these same companies had often benefited from heavy financial support from national governments and from the EU during the Covid pandemic, through emergency bailouts, recovery funding, and through the massive corporate bond purchases of the European Central Bank. An analysis by ODG has shown that Shell, TotalEnergies, Eni and Repsol – among other fossil fuel corporations – have been among the main beneficiaries of these purchases.16

Faced with criticism, the European oil majors retorted with the usual deflection tactics: oil and gas producing countries were raking in a lot of money as well, and so were renewable energy companies. So why put the blame on them only? And wasn't it a good thing to see European champions enjoying financial success? Any attempt to reduce those profits would mean harming their global “competitiveness”. Apparently, European gas majors were not interested in the impact of skyrocketing energy prices on the “competitiveness” of the rest of the European economy, with factories closing off and laying off workers.

Industry group FuelsEurope, which represents the refining industry, argued that “in the interests of maintaining fair competition, measures address all suppliers to the EU market, not only refiners and EU-based companies”, especially since its members (including Shell, TotalEnergies and Repsol) had “provided additional energy security to Europe in recent months,”17 while Repsol deemed the EU Commission proposal “counterproductive”.18

A key argument of big oil and gas to avoid any taxation of their “super-profits” - the result of energy markets running wild – was that they would need all the cash to invest in the decarbonisation of the European economy. This was quite an ironic stance in many ways.

First, as we shall see, oil and gas majors have a very particular idea of what “decarbonisation” means - in short: problematic technological solutions such as carbon capture usage and storage (CCUS) or hydrogen that are designed to delay any effective end to fossil fuel use in the short and middle term, and that they turn into an opportunity to seek even more public funding.

All the evidence suggests they are only contributing a small portion of their investments to genuine renewable energy generation such as wind and solar. According to Client Earth, between 2010-2018, Shell spent a mere one per cent of its long-term investments on sources of ‘low carbon’ energy (which also includes CCUS and other false solutions).20

Second, European oil majors have clearly opted to redistribute a large chunk of these profits directly or indirectly to their shareholders. After announcing their record profits, Shell, TotalEnergies and Eni have announced massive share buyback programmes for a total of at least €25bn. TotalEnergies further announced an “exceptional” dividend of €2.6bn, that would come on top of their “normal” (and increasing) yearly dividend.

The sheer level of profiteering could not just bring down energy bills, but also provide finance for those already facing the impacts of climate change. Analysis by Oxfam shows that in the first half of 2022, six fossil fuel companies combined made enough money to cover the cost of major extreme weather and climate-related events in developing countries and still have nearly $70 billion profit remaining.21

Everything but taxation?

Not that European oil and gas majors were oblivious to the consequences of fast rising energy prices for households and small businesses. But they argued that this needed to be remedied through subsidies and targeted support for those who needed it, not through changing the rules of the games or tackling their excessive market power. “Capping prices is suboptimal compared to targeted support for vulnerable groups (tax reductions, social tariffs, subsidies)”, argued the ERT before Ursula von der Leyen on March 21.22

It’s still exactly the same message that was passed on again in July by the ERT: “Current recession risk is not driven by demand shortfall but supply restrictions (gas, supply chains) so generalised fiscal support is not the right response, need to focus on specific vulnerable groups. Policy should drive supply.”23 In short, the EU should find more sources of oil and gas - the very product that ERT’s members are selling - while helping the most vulnerable.

That is precisely what the French government chose to do when it announced a government-funded “discount” on petrol prices and subsidies for poor households – public money that would ultimately be borne by taxpayers. It also encouraged TotalEnergies to announce an extra discount of its own for consumers – which was explicitly presented as a substitute to taxing their windfall profits. “French consumers have received a share of our super-profits by coming to our petrol stations and buying our discounted petrol”, argued CEO Patrick Pouyanné during a hearing at the French Assemblée Nationale.

This proved a very good deal indeed for the French oil major – not only did TotalEnergies avoid any taxation of its “superprofits” in France, but car drivers rushed to its petrol station at the expense of competitors. Patrick Pouyanné ingenuously admitted that the discount would be funded by the profits from its French refineries – hence reducing their taxable profit and ensuring the company would continue not paying corporate tax in France. This was presented by Macron's government as evidence that there was no need to tax super-profits as companies were voluntarily helping consumers.24

As some EU governments such as Italy, Greece and Spain nevertheless began to introduce measures to tax some of the windfall profits of energy companies, the Commission decided to do something. It announced in mid-September that it would introduce a mandatory “solidarity contribution” from fossil fuel corporations on their windfall profits - not formally a tax, because of the difficulty of the EU's fiscal decision-making rules.25 The move, formally approved by the Council at the end of September, was spun as potentially bringing in billions of euros that would be redistributed to consumers and small businesses, but in reality was far less ambitious than what was being called for by civil society.

The devil is always in the detail and a lot of flexibility has been given to member states in how to apply the rules and what will be the basis for taxation. It is therefore difficult to assess how much exactly the contribution will eventually yield. According to the French Ministry of Finance, the French version of the “contribution” could only yield around €200m in total. Italy’s windfall tax has been met with industry resistance and brought in far less than planned.26 It is hard to see this as anything else than a purely symbolic measure, designed to end the public debate on the taxation of super-profits.

“We are the solution”

The general posture adopted by the fossil fuel industry in the first weeks of the Russian invasion can be summed up as follows: “We are the solution”. Trying to make EU leaders forget that they had got us in this mess in the first place, by blocking for decades any genuine transition towards renewables-based energy systems and by pushing for ever more gas use in the EU.27 Even though some of them were very slow in shedding their Russia assets, particularly TotalEnergies, European gas majors insisted they were going out of their way to secure gas supplies for the continent. The message was clear: in this situation of crisis, you need us to make sure you have enough gas in the event gas flows from Russia were cut off, so we should work hand in hand.

The International Association of Oil and Gas Producers (IOGP) stressed these messages in a meeting with Energy commissioner Kadri Simon on 28 March 2022, briefing officials on “the different actions that they are undertaking to help in the Ukraine crisis“ and their efforts to accelerate “production projects to boost domestic output”. IOGP proceeded by expressing “its willingness to help in a concrete way”, in particular by “assessing what the EU needs on short term (e.g. LNG terminals, regulatory issues)”, “providing data and expert assessment on potential extra domestic production and feasibility of projects for green H2, LNG plants etc.” (all of which were key parts of the RePowerEU plan) or “analysing barriers and enablers for domestic production.”28 All of a sudden, fossil fuel companies were the good guys.

The tone was similar in a letter by ExxonMobil to EU Commission Vice-President Frans Timmermans. After stressing all the measures it has taken in response to the Ukraine invasion, the US corporation's representative stressed they were “acutely aware of the challenges the European Union faces as it works to reduce its dependence on Russian oil and gas”, and believed “ExxonMobil [could] support the EU in a number of ways”, with their LNG “already flowing into Europe” and them looking at “opportunities to bring on incremental LNG supply” and “expanding the European LNG terminal capacity.”29

This was also the discourse of the CEO of TotalEnergies Patrick Pouyanné when he announced record half-year profits of more than $18bn in the summer of 2022: if his company had made so much money, it was because it had gone out of its way to secure gas supplies to Europe and make sure every European had access to energy.

Co-managing EU energy policy with the Commission

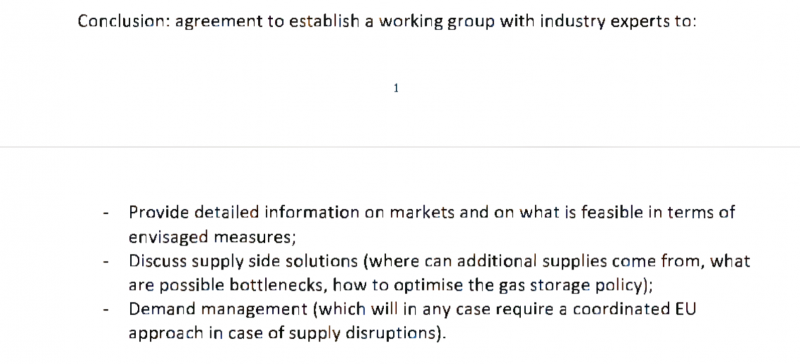

At the end of the March meetings with the ERT and energy CEOs, the President of the Commission, the Commissioner for Energy and other EU officials agreed “to establish a working group with industry experts” of the ERT to continue fleshing out the specifics of the RePowerEU plan – to assess which envisaged measures were 'feasible', where additional supply should come from, identify 'bottlenecks' (ie where new gas infrastructure should be pushed) and what kind of demand management should be enforced.30

On that occasion, Ursula von der Leyen tweeted: “I discussed with energy CEOs and [the ERT] how to diversify supply and reduce demand for gas. We will set a group of industry experts to help reduce our dependency.”

The minutes of the 21 March meeting are clear about who came up with the idea of this expert group, recounting that “CEOs offered assistance through a Task Force with company experts”.

That group – dubbed the ‘EU Energy Platform Industry Advisory Group’ – was subsequently set up to “provide feedback and comments on options issued by the Commission for natural gas and LNG (and, in the future, hydrogen) demand aggregation and joint purchasing”, and give “insights and advice” on how to ensure that the EU’s goal of “reduction of dependency on gas supplies from Russia can be achieved… with a particular focus on the diversification of gas supply”. It will provide industry representatives top-level, regular access to the Commission on the development of the RePowerEU plan and how and where the EU will source new gas, with virtually no transparency as the group operates under “an obligation of professional secrecy”.

The group, which could be mistaken for a gas industry cartel, had its first official meeting on 26 October. Its membership includes virtually every significant oil and gas corporation in Europe, including Shell, TotalEnergies, Eni and Repsol as well as BP, and industry lobby groups such as HydrogenEurope, ENTSO-G, Eurogas and Gas Infrastructure Europe as observers. There is not a single public interest organisation representative in the group - no consumer organisations even though European households are ultimately asked to pay the bill of EU policies, and no environmental organisations in spite of RePower EU’s major implications for climate action.31

This is not the only evidence of close collaboration between industry and the Commission. At the end of a meeting with the International Oil and Gas Producers Association (IOGP) at the end of March, Energy Commissioner Kadri Simson “suggested that discussions on concrete cooperation could continue at service level,”32 i.e. with lower-level Commission staff. As we have no information about meetings with industry representatives beyond high level Commission officials, such “concrete cooperation” can take place without any public scrutiny.

This close involvement of the fossil fuel industry was also what CCE argued for during its May meetings with the Commission when it came to organising the EU’s joint gas purchasing Platform. According to CCE, “gas is a specific sector that cannot be compared with others” such as vaccines, and therefore gas companies “must be closely involved” in its design as “this is concrete business”.33 This is exactly what the fossil fuel industry got: business interests trumping consumer or environmental interests, with the platform packed with Europe’s main gas companies.

At the end of March, the EU Commission agreed to set up a “Joint Task Force for Energy Security” with US authorities, with the objective of coordinating policy and securing US gas supplies to Europe. Membership of this task force has not been disclosed and there is precious little information about its meetings, but it seems like another instance of secretive decision-making bodies heavily influenced by the fossil fuel industry, where climate and social concerns have been sidelined.34

More of the same: ramping up support for gas infrastructure and gas-based technologies

According to the fossil fuel industry, the problem was not the market and it was not Europe's over-dependence on oil and gas that had made it vulnerable to both Russian influence and highly speculative energy markets, while locking it into a climate-destroying trajectory. It was that there was just not enough gas infrastructure to compensate for the potential end of Russian gas inflows. Conveniently forgetting that they had put the EU in this fix in the first place by arguing that Europe needed more and more gas for its energy transition instead of focussing on renewables, the fossil fuel doubled down on its claims, demanding even more gas infrastructure to solve the crisis.

Some fossil fuel CEOs even use the opportunity to suggest that the cause of the current crisis was to be found in the excesses of the “energy transition”, that had hampered investments in fossil fuels and particularly in exploration & production. In fact, analysis shows that in the first quarter of 2022, as skyrocketing gas prices fueled inflation, electricity produced from wind and solar actually saved the EU €99 billion in avoided gas imports.35 Despite this, investments in renewable energy still pale in comparison to the billions of euros spent on fossil fuel based projects and fossil fuel subsidies up to this day.

This misleading case was made by an Axpo board member and a representative of Maire Tecnimont during parliamentary hearings in Italy.36 Many fossil fuel companies similarly argued that now was the time to boost gas production in Europe itself in spite of environmental considerations, and some voices were heard that called for a return of fracking on the continent. So some fossil fuel representatives seemed to suggest the Ukraine crisis was enough reason to forget altogether about the EU’s climate objectives and the need to give up new fossil fuel projects in the name of the climate emergency.

Most corporate leaders, however, struck a more conciliatory tone, arguing that it was necessary to boost both gas infrastructure and renewable energy projects – by bringing additional financial support and by “simplify[ing] and speed[ing] up permitting procedures for… energy production and infrastructure projects”, in the words of BusinessEurope.37 This deliberate confusion between gas-based projects (including derivatives such as blue hydrogen and CCUS) and a genuine renewables-based energy strategy has been a constant feature of the gas industry's lobbying offensive during the last decade. The ERT itself told Ursula von der Leyen, President of the Commission, that “the key to emerge from war, recession and pandemic is greater investment in infrastructure, research & innovation.”38

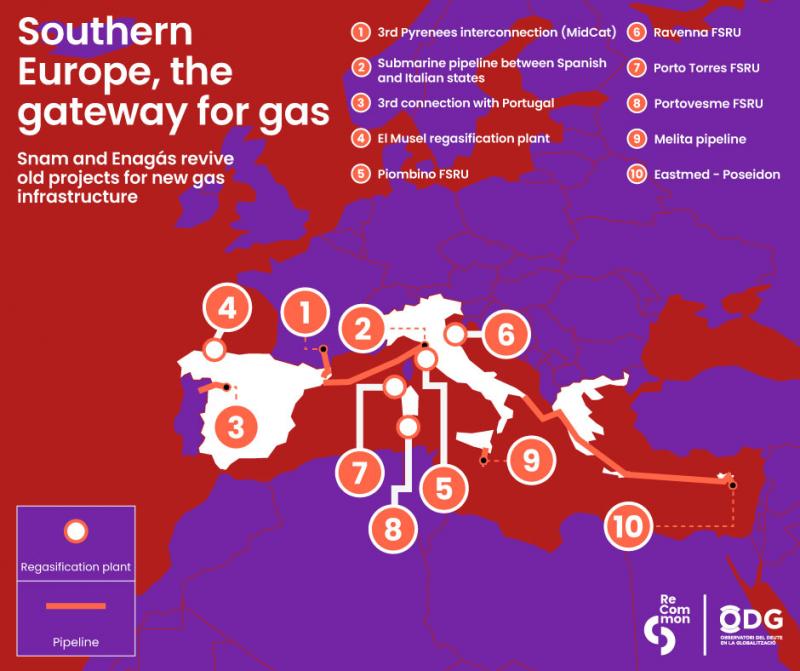

In Italy, the CEOs of Eni, Snam and Edison asked for more LNG import infrastructures, more regasification capacity and new gas pipelines within Italy itself and to boost transport capacity between Italy and Spain, North Africa, and the Eastern mediterranean (EastMed project). ODG and ReCommon have listed no less than 5 new regasification plants and 5 new gas pipelines planned between the Iberian Peninsula and Italy to boost gas transport in Southern Europe alone.39 In France, TotalEnergies received public funds to create a floating regasification plant in Le Havre, with simplified permitting procedures.

Some of the projects revived under the pretext of the Ukraine crisis had been shelved precisely because of their substantial costs and their dubious benefits. This was the case for instance for the MidCat gas pipeline between Catalonia and France, designed to facilitate gas exports from Spain to Germany and the rest of Europe. The French government opposed the project in particular because of its price tag, which would ultimately have to be covered by gas consumers.

In the end, MidCat was yet again shelved, to be replaced by an even pricier underwater gas pipeline between France and Spain.40 It is likely that all the new gas infrastructure projects that will be launched under the pretext of the Ukraine war will similarly keep energy bills high for decades - both through passing on the infrastructure and operation costs to bill payers, and by keeping Europe at the mercy of volatile gas markets. Again, fossil fuel companies will benefit, and consumers will pay the price.

Fossil fuel companies also took the opportunity to push for even more support to some of the usual dubious solutions they had been pushing for over the years to deflect criticism and delay decisive climate action. These include “green gas” (also known as renewable gas or biomethane),41 carbon capture and storage, and hydrogen. In a parliamentary hearing in Italy, Snam argued that the EU should increase financing for hydrogen production in North Africa – exactly the strategy that the European fossil fuel industry has been pushing for years as its solution to meet the bloc's climate objectives while keeping itself in business.42

A direct consequence of this new push for gas infrastructure was seen when Industry advisory group ENTSO-G released its new 10-year plan on 21 October,43 which includes more than 300 new gas projects, including new gas interconnectors, floating LNG units and expansion of existing LNG facilities, as well as biogas and hydrogen projects. Many of these new projects were presented as a response to the “emergency” created by the Ukraine crisis - yet they will take months or years to be built, add to energy bills and lock Europe further into massive use of gas for decades to come.

Conclusion

With the setting up of the EU Energy Platform Industry Advisory Group giving oil and gas majors a hand on the wheel of the RePowerEU plan, the more than 300 new gas infrastructure projects pushed by industry body ENTSO-G, it seems the fossil fuel industry has managed to tighten its grip on EU energy policy in the short and in the long-term.

It has also managed to hinder any significant political action on energy prices or on the taxation of windfall profits, effectively getting away with a very symbolic “contribution” that will do nothing to alleviate the burden for consumers and taxpayers. And it is continuing to rake in billions in profits.

Most of all, once again, the fossil fuel industry’s capture of the Commission and Council of the EU and to a lesser extent the European Parliament has closed the debate to policy alternatives. The crisis that followed the Russian invasion of Ukraine should have been an occasion for a radical change of approach: taking back public control over the energy sector and reducing the power of energy giants, asserting the basic right to energy over corporate profits, directing public funding to genuine energy savings policies in housing, transport, etc., developing resilient, decentralised, renewables-based energy systems throughout Europe, and so on. Instead, the EU has only reduced its dependence on Russian gas by increasing its overall dependence on gas and the gas industry altogether, locking us in a spiral of high energy prices, corporate profiteering, fossil fuel addiction, and climate disaster.

Disclaimer: Corporate Europe Observatory, l'Observatoire des Multinationales and Recommon are supporters of the informal Fossil-Free Politics coalition. The content of this publication is the sole responsibility of CEO, l'OM and Recommon and should not be regarded as reflecting the position of any of the over 200 organisations supporting the call for fossil-free politics, including the founders.

Footnotes

3. For instance, a request from Global Witness about the details a meeting between Energy Commissioner Kadri Simon, Equinor and the Trans Adriatic Pipeline, the joint-venture behind the giant pipeline transporting azeri gas to the EU, has been left unanswered. In response to another request, Directorate for Internal Market claimed to hold no documents relating to meetings between Commissioner Breton and Engie on March 22, and between one of his advisors and Cefic in June. See https://www.asktheeu.org/en/request/access_to_documents_request_2022_2043#incoming-39472 and https://www.asktheeu.org/fr/request/meetings_with_industry_3#incoming-39771

4. For instance, The Danish representation was approached by Teneo, a US based consultancy and PR firms that lists Hydrogen Europe as one of its clients. Teneo also invited Anthony Agotha, one of Frans Timmermans' advisers, to talk about RePowerEU at one of their events in June, which he accepted.

5. https://www.asktheeu.org/en/request/meeting_between_edita_hrda_and_t

7. https://twitter.com/ert_eu/status/1584906407505166336

8. https://www.asktheeu.org/en/request/11822/response/39744/attach/3/2%20NOTES%20from%20Presidents%20VTC%20with%20energy%20CEOs%20Ares%202022%203021623%20Redacted.pdf?cookie_passthrough=1. See also https://www.asktheeu.org/en/request/11822/response/39744/attach/2/1%20Minutes%20of%20the%20meeting%20with%20ERT%20Ares%202022%202367032%20Redacted.pdf?cookie_passthrough=1

9. https://corporateeurope.org/en/2022/05/fossil-fuel-giants-are-shaping-eus-response-energy-crisis

11. https://corporateeurope.org/en/2022/05/hydrogen-north-africa-neocolonial-resource-grab

16. https://www.opendemocracy.net/en/oureconomy/how-big-polluters-are-profiting-european-public-aid/

18. https://theobjective.com/wp-content/uploads/2022/09/Repsol-position-paper-on-the-solidarity-contribution-ES-1-1.pdf and https://www.vozpopuli.com/economia_y_finanzas/lobby-europeo-repsol-cepsa-prepara-batalla-bruselas.html

19. https://www.ft.com/content/760ba17c-3437-45eb-841a-e5980bf3ae22

20. https://www.clientearth.org/projects/the-greenwashing-files/shell/

25. https://ec.europa.eu/commission/presscorner/detail/en/qanda_22_5490

27. https://corporateeurope.org/en/2022/04/why-europe-cant-break-free-gas-lobby

29. https://www.asktheeu.org/en/request/meetings_with_chemical_industry_2#incoming-39924

31. https://corporateeurope.org/en/AGastastrophicMistake

34. https://priceofoil.org/2022/04/14/groups-us-eu-joint-task-force-energy-security-transparency/

35. https://ember-climate.org/app/uploads/2022/10/E3G-EMBER-Briefing-More-renewables-less-inflation.pdf

36. https://www.staffettaonline.com/articolo.aspx?id=366134

39. https://www.recommon.org/en/an-italy-spain-gas-pipeline-wont-solve-europes-energy-woes/

42. See for example https://corporateeurope.org/sites/default/files/2020-12/hydrogen-report-web-final_0.pdf or https://corporateeurope.org/en/2022/05/hydrogen-north-africa-neocolonial-resource-grab