Stop the hunger brokers

Few forms of financial speculation are as perverse or damaging as the speculation in food prices, or have such dramatic and immediate effects. Despite this, the financial lobby has skillfully defended its territory and if politicians lack focus, the plans to curb speculation might be lost at the last moment.

Today could mark an important step towards ending the financial speculation on food prices that impacts hunger and food security issues around the world – but only if the politicians can hold their nerve against the financial lobby. On the 4th of September delegations from the European Parliament and the Council will meet to negotiate the final version of a big package of new rules on investments and investors called MiFID & MiFIR (Markets in Financial Instruments Directive and Regulation). These rules could be a step towards ending one of the most perverse forms of financial speculation, that of essentially betting on food derivatives, or rather food prices. Unfortunately, the exact opposite could happen too: all chances of regulation in this area could be washed away in a meager compromise.

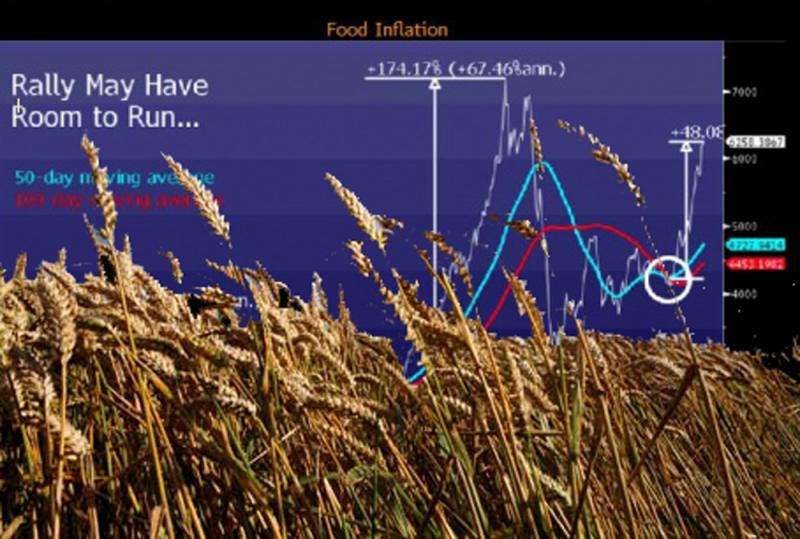

Food speculation has become a major problem in many countries around the globe over the past five years or so. A massive influx of money into speculative financial products, “commodity derivatives”, can cause food prices to rise dramatically, forcing malnutrition and hunger on millions of people. This has triggered a debate which has raged for several years over what remedies to take. The solution is really rather simple: you limit the money invested in food “commodity derivatives” with so called “position limits”, or limits to the amount an investor can put into these derivatives.

It goes without saying that a limit on speculation does not go down well with the financial sector, so from the moment the EU institutions (and the US) started considering imposing position limits on agricultural commodity derivatives at a G20 meeting in November 2011, a campaign kicked off to convince legislators that there was really no need to act. In its first phase, it was a battle on whether position limits were even needed, and if so, if it should not simply be left to stock exchanges to deal with as they thought best. When that failed, the plan B of the financial lobby was to convince the political decision makers that all sorts of loopholes needed to be inserted into the text so as to protect their interests. Loopholes that would exempt some trading places, exempt some derivatives, or exempt specific traders.

That’s why when the Council and EP delegations meet on Wednesday, both will bring their own proposals for loopholes, some of which are so big as to undermine the whole point of position limits completely and render the new rules ineffective. One proposed loophole, for instance, is that the derivatives not traded on stock exchanges, so called over-the-counter or OTC derivatives, would not come under any kind of position limit regime. Logically, then, if a hedge fund or an investment bank wants to speculate big time in agricultural commodity derivatives, all it has to do is choose another financial instrument.

Commodity derivatives and food speculation are actually only one of many aspects of the legislative acts being negotiated, and the final negotiations between the Council and the Parliament over the Markets in Financial Instruments Directive (MiFID) and Markets in Financial Instruments Regulation (MiFIR), are bound to be complex. That’s why there’s a real risk that the financial lobby could take advantage of this complexity. Steps towards effective rules on food speculation could be washed away in some dubious trade-off, if it’s not made clear to negotiators that the stakes are very high. There is little reason to believe the financial lobby will not be working hard against the proposals up until the very last minute.

This should be a major concern to anyone concerned with the plight of the poorest people on the planet. The politicians need to be watched closely, so that they reign in the hunger brokers.