Goldman Sachs 'updates' lobby registration and reports x14 more lobby spend in 2014, than 2013

The investment bank Goldman Sachs has revised its registration in the EU's lobby transparency register and has substantially increased its declared lobby spend from the 2013 figure of less than €50,000 to €700,000-€799,999 for 2014. This compounds Corporate Europe Observatory's view that Goldman Sachs' original registration was not a full reflection of its EU lobbying activity. Yet despite this under-reporting, for five months the register secretariat took little action and Goldman Sachs was able to secure at least four meetings with top Commission officials.

Three NGOs - LobbyControl, CEO and Friends of the Earth Europe - made a complaint to the lobby register authority in January 2015 suggesting that Goldman Sachs had substantially under-reported its true lobby spend. In the complaint we cited several pieces of evidence, including those of two EU lobby consultancies (Afore Consulting and Kreab Gavin Anderson). These two stated in their own (previous) registrations that they had received €250,000 - €300,000 between July 2013 and June 2014, and €200,000 - €250,000 for 2013 from Goldman Sachs respectively. It did not seem possible to reconcile that information with Goldman Sachs' own disclosure that they only spent €50,000 in 2013 on EU lobbying.

For comparison, Deutsche Bank declared €1,990,000 lobby spend in 2013. Credit Suisse joined the lobby register today (better later than never) and declares €1,250,000 - €1,499,999 for 2014. These higher lobby spend figures are no surprise; afterall, the post-crisis years have been busy for financial sector lobbyists.

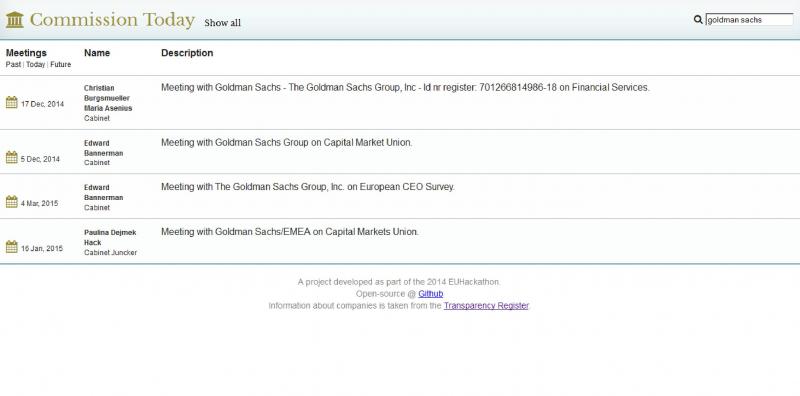

Goldman Sachs had already been a target of transparency campaigners' criticism because of their previous long-standing refusal to sign up to the EU's voluntary lobby register. They finally joined in November 2014 (using their 2013 lobby figures) just before new rules came in that would prevent non-registered lobbies from meeting with commissioners, their cabinet members or directors-general. And since the new rules came in, Goldman Sachs have made ample use of this access, meeting Commission cabinet members four times since December 2014.

That Goldman Sachs have now updated their lobby registration (as all entrants have been required to do in the past three months under revised lobby disclosure rules) and that it has substantially increased the lobby spend disclosed from 2013 to 2014 is not in doubt. But two important questions remain.

Is the new Goldman Sachs entry a full reflection of its lobbying activity? On the one hand Goldman Sachs' lobby firms have substantially reduced their declared income from the bank: Afore is down to €10,000+ and Kreab says it received less than €9,999 for 2014. On the other hand, Goldman Sachs now declares an office address in Brussels, (in a building shared, incidentally, with the financial trade association and lobby group International Swaps and Derivatives Association) although the phone number provided is Goldman Sachs' London number. Confusing. In the old registration it listed four lobbyists; now under the more precise lobby staff disclosure requirements it reports seven people involved in lobbying, although in total they account for no more than 1.8 full time equivalents.

The second question is how will the lobby register secretariat respond now? The NGOs remain of the view that Goldman Sachs' original registration was inaccurate and not a full reflection of its EU lobbying activity. Yet this lobby entry qualified it to meet with Commission cabinet members during this time. In our view, the register secretariat should have screened the Goldman Sachs entry when it first joined and they should have immediately raised questions about it.

Last week at an ALTER-EU event, Frans Timmermans, Commission Vice-President responsible for the lobby register, speaking about inaccurate lobby register entries, said: “If you lie to me you are no longer welcomed in my office”. This is tough talk but there is a long way to go to make this real. The NGOs emailed the register secretariat to make our complaint on 28 January. Yet our complaint was not declared admissible until 16 February. The secretariat then took a further four weeks to write to Goldman Sachs. As they used snail mail, Goldman Sachs did not formally receive the letter until 27 March, a full two months after we first wrote. It was then given until today to respond to the secretariat in writing; Goldman Sachs updated its registration yesterday afternoon (27 April), a few hours before the deadline for all EU lobby registrants to revise their declarations to fit the new format.

We await to hear what explanation Goldman Sachs has given and how the secretariat responds. But in our view this is a test case for Commissioner Timmermans' new policy to get tough. We need Full lobby transparency now!