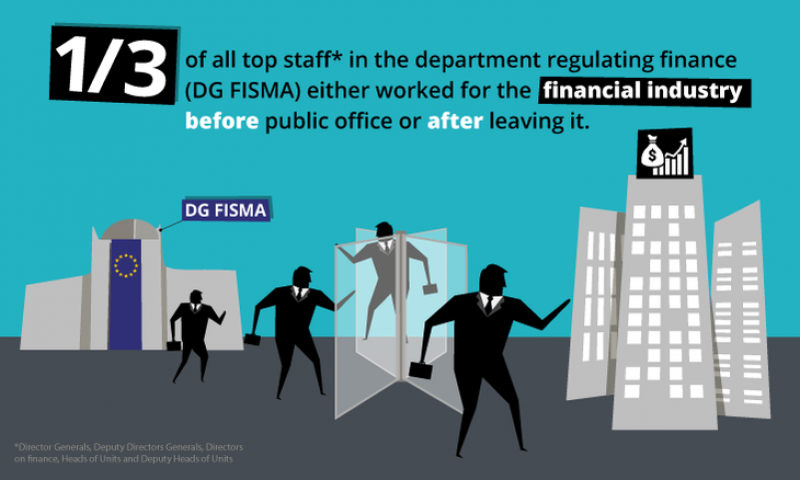

Third of top staff at EU Commission’s financial regulator came from or went into industry

Ten years after the start of the financial crisis, the revolving door continues to swing both ways at the European Commission directorate responsible for financial regulation, new research reveals.

A new study co-authored by political scientist Yiorgos Vassalos and Corporate Europe Observatory shows that a third of the people who occupied top positions at the European Commission’s Directorate-General for Financial Stability, Financial Services and Capital Markets Union (DG FISMA) between 2008-2017 either came from the financial industry or went on to work there after leaving the Commission.

The research also found that:

Four of the five former directors who headed DG FISMA at some point between 2008-17 and since left the Commission have gone on to work for financial industry companies they once oversaw, or lobby firms which represent these companies.

One of the three heads of unit who worked at DG FISMA between 2008 and 2017 and since left the Commission went on to work for the financial industry.

Six and seven of a total of respectively twenty-seven heads of unit and twenty-two deputy heads of unit at DG FISMA during this period had worked for the financial industry in the past.

Two of the three Commissioners responsible for finance between 2008-17 went on to work for financial interests following the end of their mandate.

Weeks after the European Ombudsman issued a scathing critique of the Commission’s handling of revolving door cases of ex-commissioners like that of former Commission President Barroso, this research further highlights the bias in yet another EU department’s working culture, which could benefit the financial industry actors it is meant to regulate.

Study co-author Yiorgos Vassalos said of the findings:

“The revolving-door culture at DG FISMA means many of the department’s top officials may not have the necessary distance from and neutrality towards the entities they are supposed to regulate.

“When promoting public-interest regulation could impinge on personal career prospects in the sector, the risk of undue sympathy for the industry’s vested interests is high. At the same time, DG FISMA’s frequent recruitment of staff from banking industry actors may well contribute to a pro-corporate bias at the EU department.”

Corporate Europe Observatory’s ethics campaigner Margarida Silva added:

“ The Commission rules for mitigating potential conflicts of interest have failed to stem the tide of recent revolving-door cases and must urgently be strengthened. Despite the devil-may-care moves of ex-commissioners and even ex-presidents of the Commission into industry jobs, the Commission still refuses to recognise its revolving-door problem as a systemic cultural issue.”

“The notion that a move from a regulatory body into the regulated industry is a perfectly logical career progression must be shattered once and for all.”

Contact:

Margarida Silva, Transparency and Ethics Campaigner, Corporate Europe Observatory, margarida@corporateeurope.org, +32 28930930

Yiorgos Vassalos, vassalos@unistra.fr

Notes to editors:

Read the full analysis of the revolving door moves in the top ranks of the European Commission’s Directorate-General for Financial Stability, Financial Services and Capital Markets Union (DG FISMA).

Yiorgos Vassalos is a PhD candidate in political science at the University of Strasbourg and a teaching assistant at the University of Lille. Previously, Yiorgos was a researcher at Corporate Europe Observatory.

Methods:

The above mentioned third of all DG FISMA top staff refers to 19 of 61 top officials who served between 2008 and 2017: 12 Director-Generals, Deputy Director-Generals, and Directors on finance, 27 Heads of Units and 22 Deputy Heads of Units.

We also looked at the three Commissioners responsible for financial regulation in this period and six anecdotal cases of DG FISMA policy officers. This makes a total of 70 individuals of which 31 have gone through the revolving door and of which 29 have worked or are currently representingof the interests of financial industry actors.