Accounting for influence

How the Big Four are embedded in EU policy-making on tax avoidance

We pay our taxes, so why don’t corporations? This new report shows how the Big Four are embedded in EU policy-making on tax avoidance, and concludes that it is time to kick this industry out of EU anti-tax avoidance policy.

Download the full report. The summary briefing is available in English, Deutsch, Español, and Français.

EU policy towards corporate tax avoidance is informed by an advisory system littered with conflicts of interest. Despite all the evidence – from the various tax leaks, scandals, and parliamentary enquiries and reports – of the role the 'Big Four' global accountancy firms play in facilitating, encouraging, and profiting from corporate tax avoidance strategies, they continue to be treated in policy-making circles as neutral and legitimate partners.

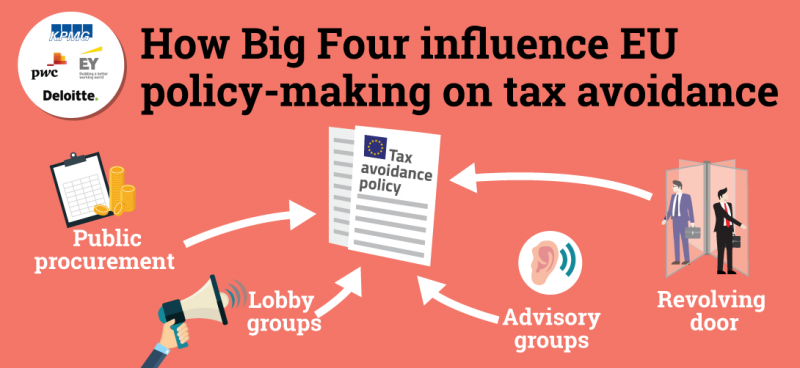

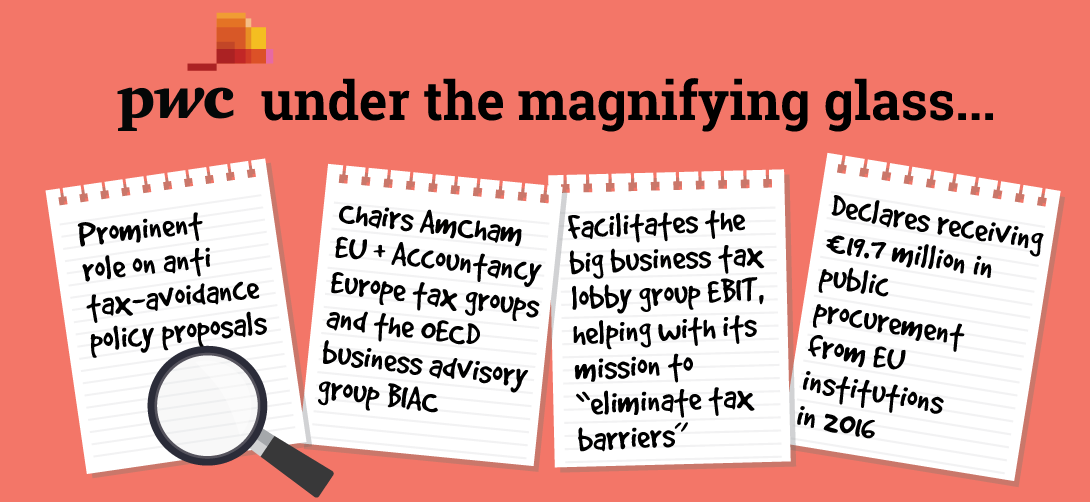

Advisory groups giving the Commission 'expert' opinions on its tax policy are populated by both corporate interests and members of the tax avoidance industry. At the same time the EU is paying millions for private ‘expertise’ in the form of tax-related policy research from the Big Four. The tax avoidance industry, particularly the Big Four, also have ‘informal’ channels of influence, using lobby vehicles like the European Business Initiative for Taxation, the European Contact Group, Accountancy Europe, and AmCham EU. And a normalised revolving door between the Big Four and EU institutions perpetuates a shared culture and ideology.

The lobbying and influence of tax intermediaries like the Big Four (and the multinational corporations they sell tax avoidance schemes to) is illustrated by two EU case studies: on new transparency rules for tax planning intermediaries, and on public country-by-country tax reporting, a proposal which is yet to be agreed by the EU institutions.

This report concludes that it is time to kick the Big Four and other players in the tax avoidance industry out of EU anti-tax avoidance policy. The starting point for this must be recognition of the conflict of interest in allowing tax intermediaries to advise on tackling tax avoidance. Only then can an effective framework emerge to ensure public-interest tax policy-making is protected from vested interests.

Download the full report. The summary briefing is available in English, Deutsch, Español, and Français.