Carbon Welfare

How big polluters plan to profit from EU emissions trading reform

The reform of the EU Emissions Trading System could hand more than €230 billion in subsidies to energy intensive industries, a new report from Corporate Europe Observatory shows.

The Emissions Trading System (ETS) is at the centre of EU climate policy, and a Directive currently passing through the European Parliament and Council intends to keep it that way until 2030. The EU ETS claims to make big polluters pay, but has actually become a way of enhancing polluter’s profits, as well as undermining and preventing effective action to tackle climate change.

- Some of Europe’s most polluting industries have been lobbying for a giveaway of more than €175 billion worth of pollution permits between 2021 and 2030, subsidies that amount to a carbon welfare scheme for big business, with ordinary citizens picking up the bill.

- Energy-intensive industries have lobbied hard for an EU-wide scheme to compensate them for electricity price rises caused by emissions trading. For example, aluminium producers have gained Italian government support for this scheme in the Council. The cost of these electricity subsidies could be anything up to an additional €58 billion – money that would prop up big polluters, rather than investing in the transformation to a cleaner economy.

- A report by Ian Duncan MEP, who plays a leading role on ETS reform in the European Parliament as rapporteur of the ENVI Committee, suggested a new loophole for offshore oil and gas producers that is worth €1.7 billion. Duncan has previously suggested that his “energy priorities” include opt-outs from emissions reduction targets for offshore installations, and ensuring that “the EU must not pass law that threatens Scotland’s oil and gas industry”.

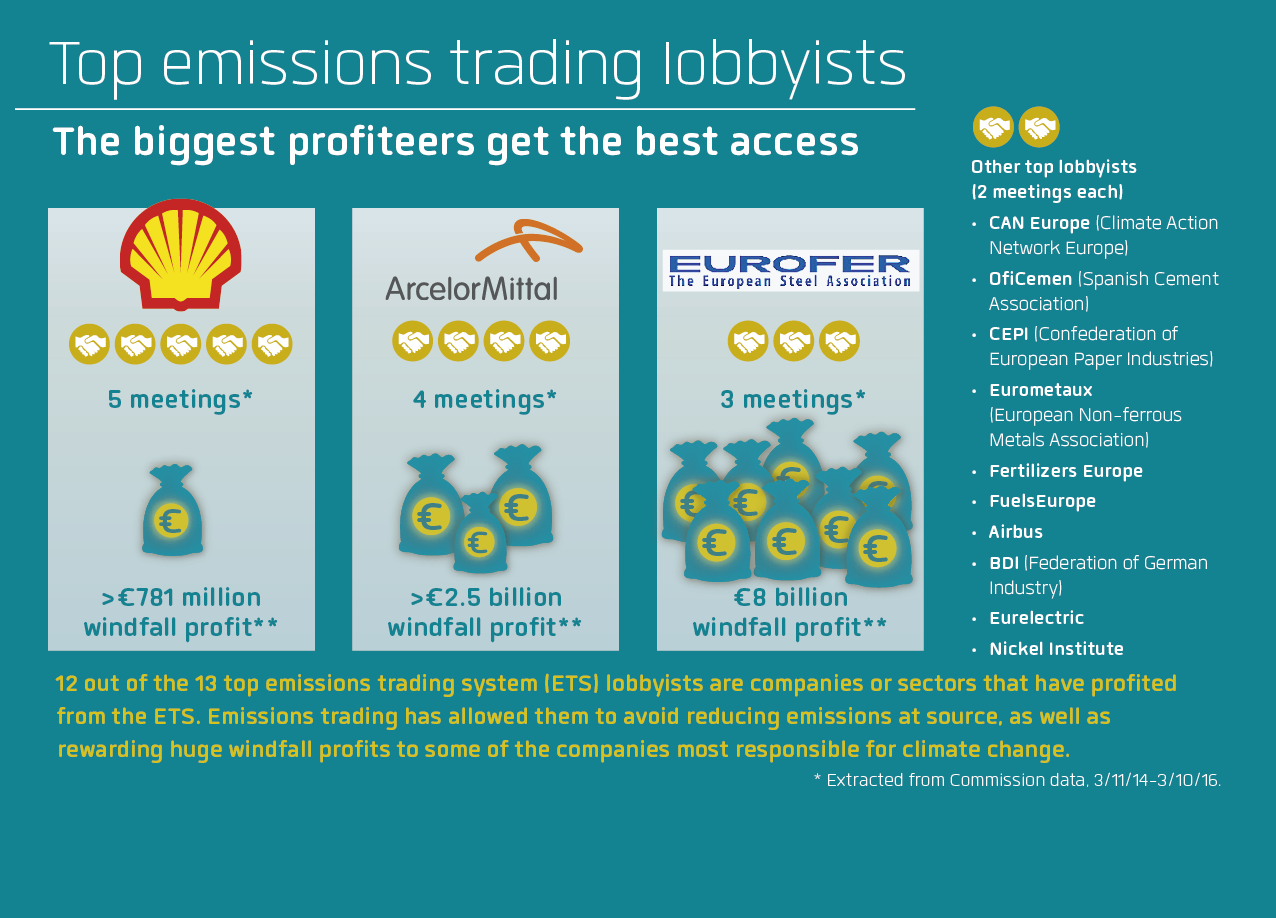

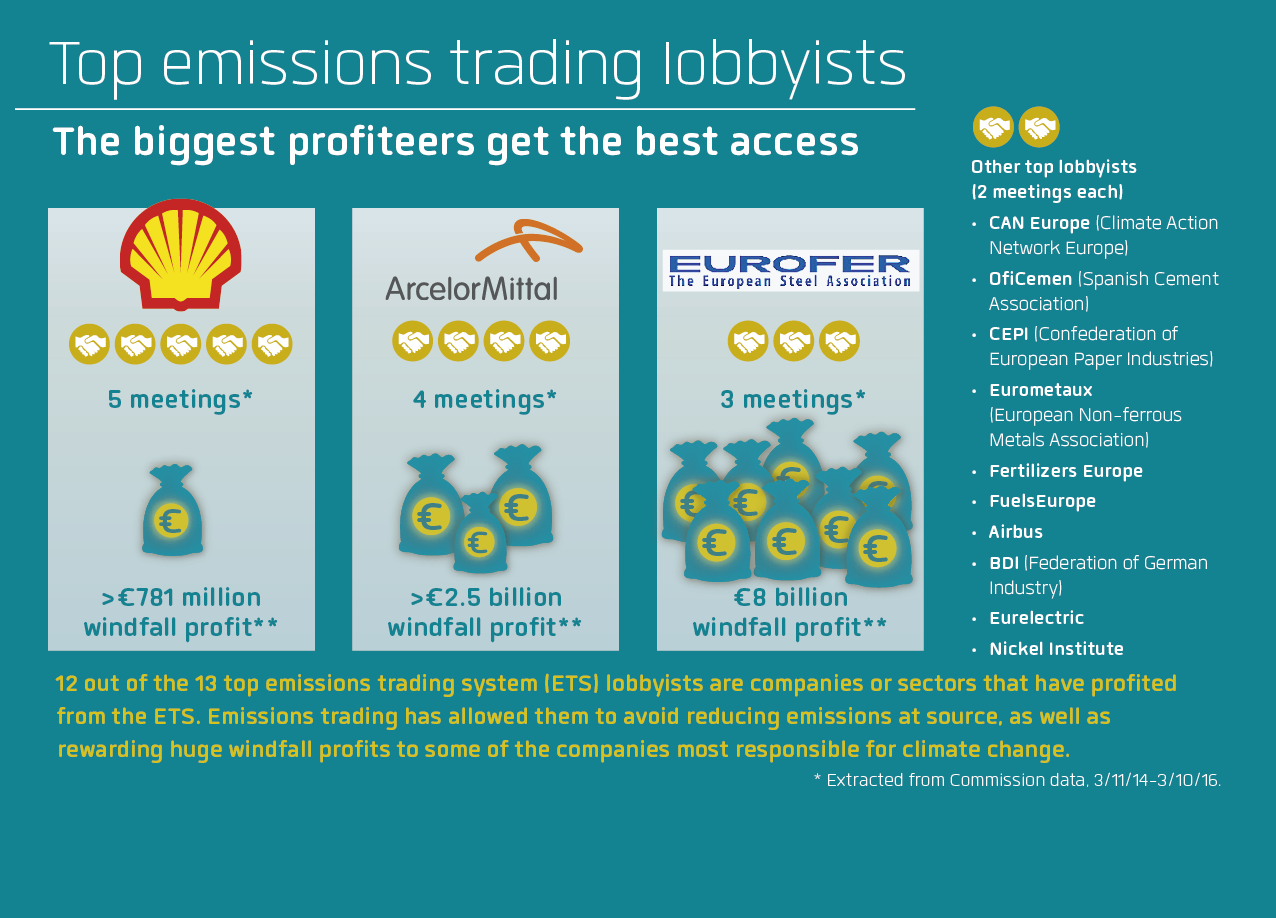

- Over the last two years, the Climate and Energy Commissioners met business lobbyists seven times more than public interest groups to discuss emissions trading. Shell, ArcelorMittal, and Eurofer (European steel association) were the top lobbyists.

- Eurelectric (European electricity industry association) has argued strongly in favour of emissions trading, and recently came out for a tougher emissions reduction target than the Commission. But lobbyists for the big electricity firms are using emissions trading to defend against more effective policies to combat climate change. In particular, the Magritte Group has lobbied for energy efficiency targets and renewable energy support to be watered down in the name of defending the carbon price – while at the same time, lobbying for continued fossil fuel subsidies as part of the 2016 Winter Package.

- Eurelectric and electricity companies from central and eastern Europe have demanded the continuation of opt-outs (“article 10c”) and subsidies that have so far brought €12 billion worth of subsidies – mostly for coal power. The Greek public power corporation, with support from several MEPs, has lobbied for an opt-out that could result in over €1.7 billion in support for two new coal power plants.

- “Full spectrum lobbying” from Brussels associations, notably BusinessEurope and energy-intensive sectors, echoed by national federations and local companies has exerted considerable pressure on MEPs to extract more free subsidies from the ETS. They claim emissions trading could shift investment outside the EU and threaten jobs, although several studies have debunked this myth, with trade rules (combined with poor pay and conditions elsewhere) posing a far bigger threat to European industry.

All data in this executive summary are fully referenced throughout the report. Download the full report or continue reading below.

AcknowledgementsPublished by Corporate Europe Observatory, December 2016 |

1. Emissions trading: a gift for corporations

There is something zombie-like about the world’s largest carbon market, the EU Emissions Trading System (ETS). It has consistently failed to reduce greenhouse gas emissions, yet it has been repeatedly brought back from the dead by successive reform proposals. The latest such revision, the “Directive to enhance cost-effective emissions reductions and low carbon investments”, would extend the scheme until at least 2030.1

A revised ETS Directive is like red meat for the hungry pack of lobbyists that work the corridors of Brussels’ political institutions. Even minor differences in how pollution permits are handed out can result in profits or savings of millions of euros to big polluters. The last major revision of the ETS saw the European Parliament’s lead on the issue, Avril Doyle, “besieged” by lobbyists.2 She counted approaches from 168 different lobby groups – the vast majority representing corporate interests.

Ultimately the Parliament will determine whether my assessment is correct. For those who would seek a different outcome, I say: "get lobbying". That’s how law is made in the EU, after all.

- Ian Duncan MEP, ENVI rapporteur on ETS reform3

While some of the methods have evolved, corporate lobbyists (and their friends in some governments) continue to advocate for the same two key goals: a climate policy focused on emissions trading rather than other forms of regulation, and a series of opt-outs and subsidies that allow them to profit from the scheme.

What is the ETS, and how has it performed?The Emissions Trading System (ETS) is the European Union’s flagship climate policy. It is intended to establish a legal limit (or “cap”) on carbon dioxide emissions (and more recently, those of other greenhouse gases) by making it expensive to pollute beyond this limit. The basic idea is that it sets an overall legal limit on the CO2 emissions of over 11,000 power stations, factories, and flights covered by the scheme, which operates in 31 countries and accounts for almost half of the EU’s greenhouse gas emissions. Each “installation” then receives permits to pollute, which are known as European Union Allowances (EUAs). The ETS is supposed to provide incentives to companies who pollute less by allowing them to trade surplus permits with other companies. But the cap has been so generous that permits have been over-abundant and their price has collapsed, meaning that there is no incentive to reduce the emission of greenhouse gases. It has failed to make any substantial dent in the EU's greenhouse gas emissions, while returning billions of euros to big polluters in the form of unearned profits. Although the EU's greenhouse gas emissions have fallen in the decade since the ETS began operating, including in the sectors covered by the scheme, there is little evidence that emissions trading caused these reductions. Electricity generation accounts for the majority of emissions covered by the ETS, but reductions in this sector are largely the result of other environmental policies, notably feed-in tariffs and green certificates.4 More generally, analysis of economy-wide drivers of changing levels of greenhouse gas emissions has shown that reductions in ETS sectors can be explained almost entirely by a combination of increases in renewable energy, the economic downturn post-2008, improved energy efficiency, and fuel switching (from coal to gas) in response to other policies and economic variables.5 |

Emissions trading: a defence against effective regulation

The EU ETS has long been promoted by industry as a defence against other forms of environmental regulation.6 The current ETS reform, and the 2030 Climate and Energy Framework of which it forms part, is no exception. Electricity generators, as well as oil and gas producers, have repeatedly suggested that securing a carbon price through emissions trading requires the EU to drop energy efficiency and renewable energy targets and subsidies – their main goal being to defend investments in gas.7 Although the lobbyists have not succeeded fully in this goal, their campaign helped to ensure that national-level renewable energy targets were dropped, while the 2030 Framework sets a minimum target for energy efficiency of just 27 per cent, which is virtually meaningless as it is likely to be achieved without any additional effort or policies.8

The lobby effort has continued with the EU’s 2016 Winter Package of energy sector reforms (which includes a revised Renewable Energy package) showing that the Magritte Group of electricity generators (dubbed the “ETS-only” gang) has worked hard to further undermine renewables.9

Emissions trading as a subsidy scheme for polluters

The EU Emissions Trading System is as much a source of corporate subsidies as it is an environmental policy – and the latest revision is likely to prove another massive boon for polluters. The Commission’s draft directive suggests that only 57 per cent of emissions permits should be auctioned, with the rest handed out for free in a giveaway worth up to €160 billion.10 As we document below, industry groups have continued to lobby for increases in the share of free allowances, as well as demanding a host of other loopholes from which they can gain further large subsidies.

Most notably, heavy industry is asking for a “harmonised” EU-wide compensation scheme for the “indirect costs” of emissions trading. This could result in EU member states compensating energy-intensive industry billions of euros to help pay their electricity bills. This would be covered by carbon permit auction revenues, although giving a massive rebate to big polluters would severely restrict the capacity of countries to use this money for measures that have a more lasting climate benefit.

Some of the auction revenues (worth upwards of €15 billion) from sales of carbon permits will also be distributed via Modernisation and Innovation Funds. The Modernisation Fund is intended to support new power sector investments in central and eastern Europe, while the Innovation Fund should support low-carbon “demonstration projects” in both the power sector and industry. These provide a further focus for lobbying.11

There can be little doubt that the EU needs to update its electricity generation and industrial infrastructure as it moves towards a low-carbon future, but the lobby effort around these funds favours proposals that could actually impede this purpose. For example, CEFIC (chemicals) and FuelsEurope (oil and gas) lobbyists have pushed for the inclusion of Carbon Capture and Utilization (CCU) in the Innovation Fund. CCU means capturing CO2 from industrial emissions for use in the production of synthetic fuels. The same greenhouse gases would then enter the atmosphere shortly afterwards from vehicles, which fall outside of the scope of the ETS – a temporary stopgap that could even hold back the spread of electric vehicles, and broader transformations in the transport sector.12

A revised ETS Directive is like red meat for the hungry pack of lobbyists that work the corridors of Brussels’ political institutions. Even minor differences in how pollution permits are handed out can result in profits or savings of millions of euros to big polluters.

The carbon leakage myth

A key part of the work of lobbyists rests on efforts to reframe the climate policy debate. A ‘frame’ in this sense is simply a way of organizing bits of knowledge about a particular subject. Emissions trading itself implies a framing of environmental regulation in narrowly economic terms, thus: the market doesn’t adequately price climate pollution (an “externality”), and pollution permits can compensate for that failure – in response to which, there is less need for other forms of regulation. And when industry lobbyists (particularly those from energy intensive sectors) talk about emissions trading, their frame is mainly the competitiveness of industry.

Alongside these narrow frames, industry repeatedly stokes up fears of ‘carbon leakage’. The argument goes something like this: lobbyists claim that the ETS poses an existential threat to European industry, and forcing companies to buy pollution permits at auction will push business out of the EU to places with weaker climate rules, therefore increasing global greenhouse emissions.13 This ‘carbon leakage’ framing has already been used successfully to pressure the European Union into handing out large quantities of free pollution permits.

But carbon leakage has no basis in fact. The most thorough study of the issue, funded by the Commission itself, is unequivocal: “We found no evidence for any carbon leakage.”14 Another recent study found that it is unlikely that such “leakage” would ever become a risk – with economic modelling that showed only tiny differences in EU imports and exports even if EU pollution permits cost ten times their current price.15

Despite this lack of evidence, European institutions have come to adopt the framing of climate policy around competitiveness and “carbon leakage” concerns to a considerable extent. When the European Council discussed emissions trading in October 2014, it recommended the continued free allocation of emissions allowances “to prevent the risk of carbon leakage” and as a means to “maintain international competitiveness.”16

Similarly, when the Director-General of DG Climate Action introduced ETS reform proposals to industry and government representatives in May 2015, he was careful to note that “carbon leakage is its major element.”17

Focusing on carbon leakage also tilts the definition of “relevant stakeholders” in the direction of big business. For example, while EU environment ministers have the lead role in shaping emissions trading policy at Council level, their first discussion on the proposed new directive in October 2015 was pre-empted by an informal debate organized by the Competitiveness Council, which brings together ministers responsible for trade, economy, industry, research, and innovation. The President of CEFIC (chemical industry lobby) and Director General of BusinessEurope were invited as keynote speakers.18 The role of these lobby groups is explained later in this report.

BusinessEurope used this and subsequent opportunities to present an even broader concept of “investment leakage”, which claims that fear of a higher carbon price (whether based on fact or not) is already reducing investment in energy-intensive industry in the EU.

2. What’s at stake with ETS reform?

The publication of the 2030 Climate and Energy Framework made clear that, for now, emissions trading remains central to the EU’s climate policy, while avoiding national level renewable energy targets, scrapping renewables subsidies, and keeping energy efficiency targets scandalously low.19 The recently proposed Winter Package, which includes a revised Renewable Energy Directive, looks set to further undermine renewable energy.20

The lobby surrounding the revised ETS directive, meanwhile, has secured subsidies and rebates that ensure polluters will not have to pay for their role in causing climate change, and will face few incentives to engage in a rapid transformation towards a cleaner economy.

Free pollution permits

The main demand from lobbyists complaining of “carbon leakage” is that big polluters continue to receive free pollution permits. In January 2008 the European Commission announced that the free allocation of pollution permits would end by 2020.21 That practice now looks set to continue to 2030. The Commission has proposed that only 57 per cent of emissions permits should be auctioned, with the rest given out for free.

The financial benefits of free pollution permits are substantial. The most recent estimate suggests that energy-intensive companies (especially in the steel and cement sectors) have made €24 billion in windfall profits from free pollution permits between 2008 and 2014.22 They could continue to profit significantly from 2021 to 2030, with the Commission’s own Impact Assessment suggesting that big polluters are set to receive free permits worth an estimated €160 billion.23

At the same time corporate lobbyists – with the backing of some governments – are angling for even more handouts. At the Environment Council, for example, Belgium tabled proposals that would reduce the share of auctioned permits to just 52 per cent, increasing the number of allowances handed out free to polluters.24 The wording of its proposal closely mirrors suggestions made by CEFIC (the chemical industry lobby), CEMBUREAU (the European Cement Association) and some other energy-intensive industries, which also want the share of auctioning reduced to 52 per cent.25 These changes could be worth an additional €15 billion in free subsidies for heavy industry.26

Other lobby proposals have approached the issue of free allowances in a more coded way – for example, by asking for greater “flexibility” in how carbon leakage claims are assessed. Another proposal, backed by BusinessEurope and lobbyists from the steel, chemical, and fertilizer sectors, would involve scrapping a “cross-sectoral correction factor”.27 That measure is supposed to ensure that a minimum of 57 per cent of carbon permits are auctioned (if the criteria for handing out allowances to individual factories initially results in a proposal to hand out too many free allowances overall, the individual totals would be adjusted downwards). It’s a good example of how lobbyists can use obscure, technical rule changes that can seem minor but would result in billions in unearned profits for industry.

Electricity subsidies

Industry lobbyists are also pushing hard to allow EU member states to compensate them for the “indirect costs” of the ETS. In theory, aluminium, steel, paper, and chemicals sectors can claim up to 85 per cent of these indirect costs in the form of state aid, but in a context of persistently low carbon prices, only a handful of countries have chosen to offer any compensation at all.28

Energy-intensive industry is now pushing for a new “harmonized” scheme that would make it mandatory for EU member states to compensate industry for “indirect” electricity cost increases, with the money coming out of carbon auction revenues. If adopted, this could be worth up to €58 billion in extra subsidies for industry.29

Transparency?The Juncker Commission has often bragged about its increased transparency.30 Two years into office, does this claim ring true? Prior to this report, CEO carried out a painstaking analysis of the 1017 meetings that Cañete, Šefčovič and/or their cabinet members had with stakeholders over the past two years (3 November 2014 to 3 October 2016).31 77 per cent were with business interests, while only 18 per cent were with public interest groups (NGOs and Trade Unions).32 These numbers already give some idea of the degree of corporate capture afflicting climate and energy policy in Europe. Many lobby meetings also take place with lower level Commission officials, but it has proven impossible to get an overview of these. In July 2015 ALTER-EU (of which CEO is a member) submitted an access to documents request for a list of meetings with DG climate officials.33 DG Clima responded that no such list exists. But disclosing this information is a matter of political will. When the same request was submitted to DG Fisma (the Directorate-General for Financial Stability, Financial Services and Capital Markets Union), it released a list of 465 meetings between lobbyists and staff below the level of Director-General.34 It would not be surprising if a similar pattern were also revealed for energy and climate lobby meetings held by lower level officials. In researching this report, information requests for lists of meetings, or minutes of meetings on the ETS with DG Clima, Energy, Growth and the office of Commission President Juncker and Vice President Timmermans have also resulted in very limited disclosures. The very few sets of meetingminutes that were released are little more than a handful of vague bullet points. This is a step back from past practice, where DG Clima did provide lists of meetings. In short, the Commission’s limited moves towards greater transparency should be viewed with caution, as it has also taken some steps backwards. In order to hold public officials accountable it should be possible to know who they meet, on which issues, and what they discussed. |

Fossil fuel subsidies

Free pollution permits for coal-fired power stations, which simply allow greenhouse gas emissions to continue unchecked, were one of the most notorious trade-offs with lobbyists the last time the ETS was reformed. This exemption (article 10c) is worth an estimated €12 billion to power producers in central and Eastern Europe between 2013 and 2019 – money that has mostly been used to subsidize coal power.35

The European Commission has proposed diversifying the use of funds related to this exemption, but fossil fuel lobbyists and sympathetic member states are working to ensure that the ETS will continue to support the infrastructure used to produce power from coal and other fossil fuels.

Oil and gas producers have also lobbied hard for a significant new loophole that could save them around €1.7 billion (£1.5 billion) over the period from 2021 to 2030.36 The idea is to give offshore oil and gas platforms free emissions permits to cover the electricity they produce for their own use – a measure lobbied for by BP, Shell, Eni, and the International Oil and Gas Producers industry association.37 This has found a sympathetic ear from Ian Duncan MEP, the rapporteur of the European Parliament’s Environment Committee, who is keen to keep the UK’s offshore North Sea production afloat.38

Some of Europe’s most polluting industries have been lobbying hard for a giveaway of more than €175 billion worth of pollution permits between 2021 and 2030, subsidies that amount to a carbon welfare scheme for big business

Emissions reduction targets

The ETS is intended to cut 43 per cent of the greenhouse gas emissions in the sectors it covers, as part of an overall goal of reducing EU emissions by 40 per cent (compared to 1990 levels) by 2030.39

This translates into an annual reduction target (called the “linear reduction factor”) of 2.2 per cent. While that is higher than the current goal of 1.74 per cent by 2020, it falls a long way short of what is needed for the EU to take on its fair share of global action to stabilise climate change at around 2°C of warming, let alone the 1.5°C target that is referenced in the Paris Agreement.40

Some amendments proposed in the European Parliament have suggested increasing this linear reduction factor in light of the Paris Agreement, but these were voted down in the ITRE (industry) Committee in October 2016 and are not likely to survive the Parliamentary phase.41 Despite rushing to associate themselves with the Paris Agreement, there are also very few signs that member states are preparing to consider a higher figure at Council.

3. How industry lobbies on emissions trading

The echo chamber

There are an estimated 20-30,000 lobbyists in Brussels. Whether representatives of individual companies (or PR firms acting on their behalf), ad-hoc or allied groups of companies, issue-specific coalitions, sectoral industry associations, industry-linked think tanks, national or European-wide industry groups, all come knocking on the doors of the Commission and Parliament in the course of passing new legislation like the revised emissions trading directive.

While a lack of transparency makes it difficult to prove patterns of planned coordination between lobbyists, the combined effect of their actions is clear: an echo-chamber that brings in similar messages from all directions, putting pressure on the Commission and Parliament, while at the same time working with partners in EU member states to ensure that the same talking points are reflected in the Council.

The lobby in favour of a single climate target is a case in point. When the Commission started working on its 2030 climate and energy objectives, its starting point was a system of separate targets for greenhouse gas emissions, renewable energy, and energy efficiency, each of which were related to national targets and a set of policies aimed at achieving them.42

The existence of separate targets helps to ensure that climate measures favour long-term solutions, rather than merely encouraging incremental changes in a fossil fuel-based energy system, which can lock-in redundant technologies for decades to come.4543 Separate targets also make it harder for countries and companies to avoid action by simply manicuring statistics.

Energy companies and their trade associations argued that the EU should now reject this model, instead adopting a single climate target to be implemented in large part through a revised emissions trading system. The big energy companies argued that this was the best way to match competitiveness concerns with environmental ambition. In fact, their main objective was to undermine renewable energy targets and subsidies because they threatened investments in gas in particular, and energy efficiency measures, which would reduce demand for their product and so eat into their profits.4644

In October 2011 Shell fired the first shots in a long battle, proposing to the Commission that it should scrap EU renewables and energy efficiency targets in favour a single greenhouse gas target, with the ETS as the main policy for delivering this.4745

The next month, BP proposed the same objective, and was joined in this effort over a two-year period with a concerted push from Eurogas, the European gas producers’ lobby, and the International Oil and Gas Producers (IGOP) association.4846 Formal lobby efforts ran alongside informal contacts, as executives courted the Commission at dinners, cocktail receptions, and even birthday parties.47

The pressure for a single target mounted in 2013, as the Magritte Group of electricity generators (see section 4 below) started to actively lobby for a single target.48 Many of the same companies joined forces with big oil producers to create a One Target Coalition at around the same time. In November 2013 this group’s representatives met with Peter Vis, Head of Cabinet for Connie Hedegaard (then Climate Commissioner), and his Deputy to reinforce their single target message.

BusinessEurope weighed in with a range of letters, position papers, and events with decision-makers. In February 2013, for example, it wrote to the then-President of the European Commission, José Manuel Barroso, complaining that “the uncoordinated implementation of emissions trading, renewable targets and energy efficiency objectives is creating unpredictability and excessive costs for energy investors and consumers”.49

The Commission’s 2030 Climate and Energy Framework, first published in January 2014, showed some clear results from all of this lobbying.50 Although the proposal maintained renewable energy and energy efficiency targets alongside an overall climate target, these were stripped of much of their force, with the renewables target significantly weakened through the scrapping of national-level targets.

The Commission’s spin on the ETS was that it would reform the system, starting with measures to fix the chronic problem of a massive surplus of emissions allowances, and then through a revised directive.51 Less attention was paid to the fact that its proposal amounted to a significant extension of the scheme through to 2030. When the European Council approved the package in late October 2014, the weak 30 per cent energy efficiency target proposed by the Commission was reduced even further to a 27 per cent improvement by 2030.

The lobby machine did not stop with the agreement of the 2030 Framework. BusinessEurope continued to call for “the ETS as the only instrument for decarbonisation of industry”, listing this as one of its key priorities for the new Commission in October 2014.52

When Miguel Arias Cañete took up the post of Climate Commissioner, he was immediately invited to a meeting with Eurelectric’s President (and CEO of E.On) Johannes Teyssen to exchange views on the ETS and 2030 policy framework.53 Eurelectric has since reiterated its position that the ETS should be “the main driver for renewables investments”, which it claims would require minimizing “renewables support” through subsidies.54

The European Roundtable of Industrialists (ERT), meanwhile, wrote to Cañete in February 2015 to suggest that the new 2030 framework be interpreted to mean that “Energy efficiency measures should focus more on sectors outside the EU ETS.”55 Their intention was to discourage the EU from putting specific policies in place to encourage efficiency in electricity generation or manufacturing.

The main fruits of this fresh round of lobbying can be seen in the Winter Package, which opens the door to the extension of fossil fuel subsidies while putting the brakes on support for renewables.56 But it has also softened the ground for using the carbon price as a pretext for further weakening renewable energy or efficiency measures.

“Our request for a well-functioning and improved ETS could be significantly undermined with the impact of the multiple policies that overlap with it and that create additional costs,” wrote BusinessEurope in a February 2016 lobby paper, which warned in particular about the impact of renewable energy and energy efficiency directives.57

This position was then inserted into European Parliament proposals on how to amend the ETS directive, through the interventions of the right-of-centre European Peoples’ Party and European Conservatives and Reformists MEPs on its environment and industry committees. A Draft Report from Ian Duncan MEP, who as the Environment Committee’s rapporteur has the lead role in the Parliament’s ETS reform, suggested that future monitoring should include a specific focus on “the interaction of the EU ETS with other Union climate and energy policies, including how those policies impact upon the supply-demand balance of the EU ETS”.58 A very similar wording has been proposed by the ITRE (industry) Committee.59 This offers potential hooks for lobbyists to chip away at the renewable energy and energy efficiency directives in future. There is some precedent for this – most notoriously, when staff at DG Clima advised against tougher efficiency measures for fear of collapsing the carbon price.60

Divide and conquer at the Commission

When the European Commission creates a new directive, the task of formulating the legislation is delegated to one of 33 policy-specific departments (called Directorates General), which often have quite distinct institutional cultures, agendas, and lobbyists to whom they are willing to open their doors. DG Clima (Climate Action) has the lead role on emissions trading, as part of the EU’s broader climate and energy framework, but this does not mean its position goes unchallenged.

When the ETS was last revised in 2008-2009, for example, energy intensive industries lobbied extremely hard against a Commission proposal to phase out the auctioning of pollution permits from 2013-2020. They won significant concessions, which allowed most industries to continue to receive permits for free. A system of “carbon leakage lists” - official designations of which sectors and sub-sectors of the economy were deemed to face threats to their competitiveness – was set up to determine how many permits each sector would receive. DG Enterprise was then given the task of setting up these lists, which marked a significant victory for its allies in BusinessEurope, since this assured a more sympathetic hearing for industry when criteria were established.61

In 2011 DG Clima proposed to exclude carbon offsets from the ETS – a belated recognition that a UN-backed system of credits for emissions reductions in developing countries lacked environmental integrity and were often generated by projects that harmed people living in their vicinity.62 Since these credits had offered a cheap way for European companies to dodge their climate responsibilities, business lobbyists sought to apply pressure, in alliance with officials from DG Enterprise, to have the DG Clima stance reversed.63

The setting of 2030 targets was a further case where division arose within the Commission. Günther Oettinger (then EU Commissioner for Energy) set himself against DG Clima’s proposal of a 40 per cent climate target by 2030.64 He was also opposed to the setting of a separate energy efficiency target (a measure still favoured by DG Clima), arguing instead for a weaker “energy intensity” proposal that had been put forward by German chemical companies BASF and Bayer.65

In the process of revising the emissions trading directive business lobbyists have again attempted to exploit cracks within the European Commission. With the reorganization of the European Commission in 2014, DG Enterprise was scrapped, with a lot of its work taken up by the new DG Growth (the Directorate-General for Internal Market, Industry Entrepreneurship and SMEs). The steel and chemicals sectors, which are heavy energy users, sought to work their contacts there to undermine the proposals starting to emerge from DG Clima.

“Intelligence gathered from recent meetings indicates that DG Clima are already well advanced in their thinking as to how to reform the carbon leakage arrangements,” a representative of CEFIC wrote to his counterpart in DG Growth in 2015, warning that its approach was “seeking to drive a wedge between different sectors in the energy intensive industries: a divide and rule strategy which would leave them free to push the above proposals through the system.” He concluded, pointedly, “This approach flatly contradicts the EU’s goal of economic recovery and growth,” a phrase that could almost have been lifted from the mission statement of DG Growth itself.

ArcelorMittal was similarly scathing of DG Clima in correspondence to DG Growth, with the former’s Impact Assessment on the proposed emissions trading directive drawing particular ire. It openly countenanced options that could see DG Growth, and the business-friendly “High Level Group on Administrative Burdens” (Stoiber Group) intervene on the question of the impact assessment.66

A new “High-level expert group on Energy-Intensive Industries”, established in April 2015 by Elżbieta Bieńkowska, the Commissioner in charge of DG Growth, further increased the pressure on DG Clima. Such groups are particularly influential at the early stages of legislative process, helping to shape (and sometimes even draft) Commission directives.67

The 35 members of the Energy Intensive Industries (EII) expert group includes 10 from industry, including most of the main groups lobbying on the ETS, as well as 4 industry-linked research groups, with most other members of the group coming from governments.68 This allowed lobbyists, who have a coordinated line, to dominate the agenda. Minutes of its May 2015 meeting record that “Industry sectors were very united concerning the priorities for the group and issues relevant for ETS reform.”69 The main takeaways from the expert group read like a shopping list of the industry lobbyists’ key concerns, including strong demands for a broad carbon leakage list, compensation for the indirect costs of emissions trading, and the removal of the cross-sectoral correction factor.70

As with expert groups, the major business associations often lobby for new layers of influence within the Commission. The so-called ‘Better Regulation’ agenda is a clear example of this. Despite its name it was in fact originally promoted by the European Roundtable of Industrialists (ERT), BusinessEurope and others as a means to kill off and weaken regulation that industry dislikes.71

In late 2014 and the spring of 2015, BusinessEurope used precisely this angle to attack the ETS, writing to European Commission President Jean-Claude Juncker and Vice-President Frans Timmermans to emphasise the need for consistency between the reform of emissions trading and the ‘Better Regulation’ agenda.

Lobbying the European Parliament

Once the Commission made its proposal for a revised ETS directive in July 2015, the focus of lobby attention in Brussels predictably shifted towards the European Parliament, which has the power to propose significant amendments or even reject the proposed directive (although that outcome seems highly unlikely in this case).

The bulk of the European Parliament’s workload is handled through committees, with the Environment, Public Health and Food Safety (ENVI) Committee taking the lead on the revised ETS directive – though not before a lengthy fight for control with the ITRE (Industry, Research and Energy) Committee, which is often seen as being more sympathetic to the demands of industry.72 The messy compromise saw ITRE share competence with ENVI on some of the aspects that are most subject to industry lobbying: measures to support energy-intensive industries (article 10b), “transitional” free allocations for energy sector modernization in poorer countries (article 10c), the modernization fund (article 10d) and some aspects of the innovation fund (article 10d).73

ITRE and the Parliament’s Development Committee (which has a relatively minor role on the ETS) have issued Opinions on ETS reform, which are then considered in the preparation of an ENVI report that is scheduled for a vote on 8 December 2016. That report (and further amendments proposed by parliamentary groupings) will then be considered at a plenary session of the European Parliament in Strasbourg, which is expected to happen in the first quarter of 2017.

Working by committees means that the actual work of lobbying is focused around a handful of Parliamentarians, as one trade association lobbyist on EU climate policy explained:

“[T]here are 750-ish [MEPs]. Of whom about a tenth know anything about energy or climate or environment, and of those people about one third of them are heavyweights. So actually there’s about 25 of them who really matter – these are the coordinators, the chairmen, the National delegation heads, the experts who are... the rapporteurs... I would personally consider myself a pretty crappy lobbyist if I didn’t have the mobile phone numbers of all those MEPs, if I didn’t know exactly where their offices were, and if I wasn’t in email contact with them on a pretty regular basis.”74

The ENVI rapporteur in this case is Ian Duncan, a Scottish Conservative MEP and member of the European Conservatives and Reformists (ECR) grouping. The ITRE rapporteur is Frederick Federley, a Swedish Centre Party MEP and member of the Alliance of Liberals and Democrats for Europe (ALDE) grouping.

Shadow rapporteurs are also appointed from the major political groupings represented within the European Parliament.75 The most influential of these – and those that are most inundated by lobbying – come from the two dominant political groupings in the Parliament, the European People’s Party, and the Socialists & Democrats.

“They have various ways of putting pressure. They want private meetings... saying we’re losing market share, we’d have to close plants, we’re losing millions of euros. All intended to make us scared... It is a threatening pressure”

MEP

Pressure behind closed doors

European Parliamentarians face a full spectrum of lobbying on emissions trading reform. The strongest lobby has come from energy-intensive industry, who are focused on increasing the number of free emissions permits they receive. “They always come with the same approach,” recalls one MEP, “If you don’t give us free allowances we’ll face competition strong and have to close factories, and jobs will be lost.”76

Lobbyists particularly favour private meetings with MEPs (and, failing that, their assistants), sending meeting requests to those who are more active on ETS reform on a monthly basis, in some cases.

The style of lobbying varies according to the audience. Sometimes, lobbyists approach MEPs softly proclaiming their industry expertise, explaining why certain aspects of what are proposed is not possible.77 The accompanying lobby documents come with a bewildering array of graphs, pie charts, diagrams, and infographics. For example, lobbyists have suggested that existing improvements already bring them close to the technological limits of emissions reductions – even in cases where this is far from accurate.78

The ETS is fertile ground for this type of highly technical lobbying, since even minor differences in how carbon leakage benchmarks are set, changes in what years are taken as a reference period, or adjustments to how sectors are classified, can result in billions of euros in free allowances.

If MEPs are deemed to be sympathetic, requests for regular meetings are backed by informal relationship-building.79 For those that seem less open, though, lobbyists do not shy away from a more threatening tone, as one MEP explained:

“They have various ways of putting on pressure. They want private meetings with us to tell us they are in a very serious situation, saying we’re losing market share, we’d have to close plants, we’re losing millions of euros. All intended to make us scared… It is a threatening pressure.”80

At the same time, MEPs face pressure from companies that are influential in their country or constituency. For example, the aluminium industry has pressured Italian MEPs regarding on the issue of indirect costs (compensation for electricity bills), while the steel sector talks up the risk of job losses to MEPs who have steel plants in their constituencies.81 Lobbyists representing producers of fertilizers, chemicals, cement, and glass typically come with similar points.82

In addition to private meetings, EU-level business and industry associations are very active at producing written lobby documents. ETS position papers set out key demands, often reinforced by similar messaging from national associations and individual companies. Lobbyists draft wording for amendments to the directive, in the hope that these will be proposed by sympathetic MEPs – or issue detailed sets of voting recommendations on the amendments under consideration by Parliament’s Committees.83

Public Events

Brussels lobbyists have also served up a bewildering array of ETS-related events throughout 2016 to coincide with the passage of the new directive through parliament. On 16 February, for example, Frederick Federley MEP tweeted:

“Heavy #EUETS day. 4 events on ETS and now I attend ENVI informal shadows meeting. on ETS.”84

ETS lobby events take various forms, occasionally bordering on the ridiculous: “There’s no better way to mark the deadline for ETS amendments than an ETS-themed pub quiz!” begins one flyer for an event organised by the PR firm FTI consulting on behalf of FuelsEurope, “Grab your thinking caps and treat yourself to a night filled with drinks, food and prizes.”

The most typical lobby events, though, are those that put key decision-makers on the platform, ensuring that they attend in the hope that they end up listening through the host’s key lobby points too.85 The promise of free food also tends to help. On 11 May Fertilizers Europe co-hosted a dinner debate on the meaning of ETS reform for Central and Eastern Europe – the invite for which was circulated to all Parliamentarians by Marian-Jean Marinescu, a Romanian MEP and Vice-Chair of the European People’s Party.86

On 26 October, Eurelectric invited all members of the ENVI and ITRE committees to a “working breakfast on the priorities of the power sector under the revised EU ETS”, featuring Ian Duncan and representatives of the power sector. The correspondence was circulated by former Parliament President Jerzy Buzek, a Polish MEP for the European People’s Party, in his capacity as chair of the ITRE committee.87 Many more similar examples exist.

EPP: the lobbyists’ friend

The European People’s Party is particularly crucial to industry lobby efforts, since it is both the largest Parliamentary group and one that is seen as sympathetic to the demands of industry. Climate and competitiveness are given equal billing in the group’s common position on ETS reform: “Our main concern is the competitiveness of European industry and the jobs it delivers. These need to be safeguarded while respecting our CO2 reduction targets.”88

But the actual positions taken by the EPP mostly stress measures that would offer opt-outs and subsidies to big polluters. It supports handing more free emissions permits to industry, a “harmonized” approach to compensating industry for the indirect (electricity) costs of the ETS, “a more targeted cross-sectoral correction factor”, and enhanced monitoring of “investment leakage” (for definitions, see Carbon Welfare Glossary box, below).89 All of these positions are shared with BusinessEurope, and a number of the associations representing energy-intensive industries.

A carbon welfare glossary: what big business wantsA handful of key refrains are repeated in the demands of many of the corporate lobbyists working on the ETS. While these sound diverse and technical, they mostly boil down to demands for more subsidies for industry: Harmonized compensation for indirect costsEnergy-intensive industries have long complained that, as well as having their own emissions reduction targets, the cost of emissions allowances factored into electricity prices means they have to pay more to meet their energy needs. They also claim (with some exaggeration) that they cannot pass these costs onto consumers without damaging their global competitiveness.90 Cross-sectoral correction factorThe “cross-sectoral correction factor” is a measure to ensure that the planned number of free allowances is not exceeded – a possibility that could arise because free allowances are first calculated by member states and only subsequently checked by the Commission to ensure consistency. But it also serves a second key function as a backstop to limit the overall impact of any new loopholes introduced as a result of corporate lobbying. For example, if the oil and gas industry successfully gains free allowances for the electricity used on offshore rigs, but the overall limit on free allowances remains the same, other sectors would lose out. If that is repeated across the whole ETS, industrial sectors would be competing with each other for larger shares of the same pie. Instead, corporate lobbyists want a bigger pie so that all industries get more free allowances. The losers in this scenario would be ordinary citizens and the climate, since more handouts reduce the amount of permits that are auctioned, reducing in turn the amount of money that could be invested in a shift to a low-carbon economy or absorbed back into national budgets. Dynamic allocationThe allocation of emissions permits is currently based on a system of “benchmarks”. Individual “installations” (factories, refineries, etc.) are awarded free permits according to a formula that takes into account their historical level of emissions, as well as a measure of carbon intensity for their particular sector or sub-sector.91 The total number of free allowances is capped, so if the sum of individual calculations exceeds a pre-defined limit, the “cross-sectoral correction factor” kicks in to reduce what each installation receives. Business lobbyists (led by BASF, BusinessEurope and others) argue that the current fixed allocation system should be replaced by a new system of “dynamic” (or “flexible”) allocation.92 The main feature of this proposal is that it would remove the cap. Put simply, the “flexible” element just means growing the pot of free allowances that subsidize industry. |

4. Key Lobbyists

BusinessEurope: high access, low ambition

BusinessEurope is the European employers’ confederation, speaking for businesses from 34 countries with the stated aim of “ensuring that Europe remains globally competitive.”93 In practice, its repeated attempts to obstruct and weaken EU climate policy is driven by a handful of energy-intensive industries, such as BASF, BP, and ArcelorMittal.94

BusinessEurope at a glance:Lobby spend: €4,000,000€ - €4,249,99995 |

In the debate on the 2030 Climate and Energy Framework, for example, BusinessEurope lobbied hard against a 40 per cent climate target, and in favour of scrapping separate renewable energy and energy efficiency targets. Though it failed in these over-arching objectives, it succeeded in watering down these targets in favour of a focus on emissions trading, as well as securing an intention to phase out renewable energy subsidies.98

BusinessEurope’s core lobby agenda for the revised emissions trading directive, echoed by lobbyists from all of the energy intensive industries, has been to ensure that firms continue to receive as many subsidies as possible – while complaining that the Commission’s proposal “fails to strike the right balance and, therefore, needs to be substantially amended.”99 It has reinforced this message through letters, position papers, and lobby events, as well as using its status as the European employers’ federation to gain significant access to high-level decision makers. At the same time, BusinessEurope coordinates closely with the national federations that comprise its membership, to ensure that national governments hear the same lobby points echoed back at them.

BusinessEurope’s core lobby agenda for the revised emissions trading directive, echoed by lobbyists from all of the energy intensive industries, has been to ensure that firms continue to receive as many subsidies as possible

Increased subsidies and investment leakage

BusinessEurope’s proposed amendments to the ETS focus on asking for a greater number of free emissions permits, or rule changes that would likely result in more subsidies. For example, BusinessEurope has consistently called for greater “flexibility” in how carbon leakage claims are assessed, the scrapping of the “cross-sectoral correction factor”, and “harmonized” compensation for indirect carbon costs (see Carbon Welfare Glossary, for definitions).

More broadly, BusinessEurope has framed its discussion of emissions trading around a story about “investment leakage”. In response to studies that have shown that “carbon leakage” is not actually happening as a result of emissions trading, BusinessEurope wrote to Cañete and MEPs in February 2016 that, “It is key to understand that it is not because ‘carbon leakage’ in the strict sense of relocation has been avoided that ‘investment leakage’ is not happening.”100

The concept of “investment leakage”, first introduced in lobby documents a year previously, is built around a correlation between falling EU investment in energy-intensive sectors and the costs of factoring carbon into investment decisions.101 Needless to say, no actual evidence that the one factor causes the other is offered.

In October 2016, for example, at BusinessEurope’s High-Level Conference on ETS Reform and Investment Leakage, ETS rapporteur Ian Duncan MEP, EPP shadow-rapporteur Ivo Belet MEP, and DG Clima Director General Jos Delbeke shared panels with lobbyists from Shell and CEFIC, as well as BusinessEurope Director General Markus Beyrer.102 BusinessEurope even resorted to a spurious “survey” – conducted with as much methodological rigour as an online poll – to illustrate that its members had a shared fear of “investment leakage.”103

While the Commission’s proposed directive did not originally take up the language of investment leakage, lobbying at the European Parliament has paid some dividends. The ITRE (industry) Committee of the Parliament has suggested amending the goal of “avoiding carbon leakage” to a broader objective of “avoiding the risk of carbon and investment leakage”, the new language mirroring BusinessEurope’s suggestions.104 Similar amendments have been made via the Parliament’s ENVI (environment) Committee, which will meet on 8 December 2016 to propose a consolidated set of amendments to the proposed Directive that the whole Parliament will later vote on.

Such nuances can make a big difference, sometimes worth billions of euros. If the ETS Directive eventually includes “investment leakage” as the yardstick for free pollution permits, that opens the door for ratcheting up the level of windfall profits that big polluters can make from the scheme.

Energy intensive industries: lobby with a one track mind

Energy intensive industries – which include producers of chemicals, metals, cement, fertilizers, glass, and paper – are consistently the most active lobbyists on emissions trading, since they have the most to gain financially if the rules are changed to hand out free pollution permits, or to offer EU-wide compensation for the indirect costs of emissions trading on their electricity supplies.

Energy-intensive industry lobby at a glanceAEII (Alliance of Energy Intensive Industries)In spite of being a very active lobbyist, sending numerous position papers and other documents to decision-makers in Commission and Parliament, and meeting with Commission officials, the Alliance of Energy Intensive Industries is not itself registered in the Transparency Register (although its members are). Lobby spend: €10,220,000105 BASFLobby spend: €2,300,000108 BayerLobby spend: €1,989,000110 FertilizersEuropeLobby spend: €354,400112 CembureauLobby spend: €400,000€ - €499,999114 |

When the Commission proposed the gradual phase-out of free pollution permits, starting from 2013, a huge lobby effort from these industries ensured that the handouts continued – despite the fact that the “carbon leakage” they complained about has not materialized.116 The success of their lobby efforts can be seen in how far the Commission’s position has shifted. Originally, the Commission proposed that pollution permits would be fully auctioned from 2020 onwards. Its suggestion now is that industries covered by the ETS will still receive billions of euros worth of free allowances until at least 2030.

There are several layers of lobbyists working to ensure that the subsidies from emissions trading continue. As well as having their voice disproportionately amplified by cross-sectoral groups such as BusinessEurope (see above) or the European Roundtable of Industrialists (ERT), an Alliance of Energy Intensive Industries (AEII) acts as an umbrella body to help coordinate lobbying between 14 sectoral trade associations. These include CEFIC (chemicals), Cembureau (cement), CEPI (paper), FertilizersEurope, and Eurometaux (non-ferrous metals, such as aluminium, copper and nickel) and Eurofer (steel).

National industry associations play a key role too – notably through the influence of the chemicals sector in the BDI (German Business Federation). At a more local level representatives of individual companies have sought to influence MEPs by suggesting “carbon leakage” could result in job losses in their own constituencies.117

Many voices, common demands

Energy intensive industries have tended to echo a series of common demands throughout the debate on ETS reform: asking for more free emissions allowances, “dynamic” allocation, scrapping the cross-sectoral correction factor, and harmonized compensation for indirect carbon costs (see Carbon Welfare Glossary, for definitions).

The high levels of coordination between energy intensive industry lobbyists also works to protect them against what they see as “divide and rule” tactics coming from elsewhere. In March 2016, for example, France and the UK proposed a “tiered approach” to the allocation of free permits in the fourth phase of the ETS (2021-2030), which is covered by the new directive.118 The proposal would divide companies into four tiers, compared to the two proposed by the Commission, in an attempt to focus free pollution permits on the sectors perceived as being most exposed to the risk of carbon leakage.

This proposal initially created splits between industry lobbyists, with the steel and fertilizer sectors reportedly open to the suggestion – calculating that it would not harm their chances of receiving free allowances, and may even enhance their subsidies. In April 2016, however, BusinessEurope was already putting out a paper expressing “strong reservations on such an approach”,119 while AEII put out a statement (notably, missing Eurofer and FertilizersEurope as signatories) suggesting that “the ‘tiered approach’ would introduce an unnecessary and unfair discrimination between sectors.”120 By September 2016, a group of 15 energy-intensive industry associations had signed up to a common statement rejecting tiering. While this was still not endorsed by the fertilizers and steel lobbies, they also closed ranks around the rejection of tiering.121

Aligning “national” interests with industry interests

Energy intensive industries also lobby hard at the level of EU member states, and with some success. For example, aluminium smelters in Italy have pushed for an EU-wide scheme that would compensate the full “indirect costs” of the ETS (in terms of electricity prices), a stance that Italy has supported at Council, in a joint position with France.

Italian MEPs have also been targeted by the aluminium lobby. It appears to be no coincidence that seven Democratic Party MEPs (from the Socialists and Democrats grouping) submitted an amendment to the ENVI Committee calling for, “A centralised arrangement at European Level... to compensate installations... exposed to a genuine risk of carbon leakage due to significant greenhouse gas emissions costs passed through to electricity prices.”122 The fact that five Forza Italian MEPs (from the European Peoples Party) submitted a virtually identical amendment does not seem coincidental either.123

The cement sector also appears to have a champion in the Council, with Spain lobbying to ensure that cement remains in the list of sectors at risk of carbon leakage. When the ETS was last reformed, the cement sector successfully qualified for free pollution permits under carbon leakage rules – despite strong evidence that the sector has a tiny exposure to international competition – largely thanks to significant pressure from France on behalf of cement giant Lafarge.124 As one MEP noted, it is clear to everyone by now that cement should not be among the sectors covered, but this might still be the case if Spain keeps up the pressure.125

The steel sector: it’s the jobs stupid!

The steel sector is the most active of all industries lobbying on emissions trading, with Eurofer, a trade association that includes national steel associations and the biggest steel companies, and ArcelorMittal leading the charge.

Steel lobby at a glanceEuroferLobby spend: €600,000 - €699,999126 ArcelorMittalLobby spend: €1,500,000 - €1,749,000129 Tata SteelLobby spend: €300,000 - €399,999131 ThyssenKruppLobby spend: €800,000€ - €899,999133 |

Steel lobbyists have repeatedly argued against ambitious climate targets. Back in 2009, for example, they were at the centre of efforts to install “carbon leakage” exemptions at the heart of the ETS.135 As reward for that effort, steel companies now have the dubious honour of being the biggest profiteers from EU emissions trading. As shown in the graphic on page 21, steel companies made €8 billion in windfall profits from the ETS between 2008 and 2014.136 ArcelorMittal, the largest and most vocal of these companies, accounts for over €2.5 billion of this total.137 The biggest share of these profits came from making inflated claims about what emissions trading would cost, and then passing the bill for that onto consumers.138

Steel lobbyists were at the centre of efforts to install “carbon leakage” exemptions at the heart of the ETS. As reward for that effort, steel companies now have the dubious honour of being the biggest profiteers from EU emissions trading

Despite strong evidence showing that steel companies “strategically exaggerate their vulnerability to carbon pricing”, steel sector lobbyists are again demanding that the EU gives them more free pollution permits until 2030.139 The demands made by steel companies echo those made by other energy-intensive industries: more free pollution permits (“without correction factor”); a guarantee that the indirect costs of carbon (higher electricity prices) will be fully compensated in all EU member states; and more “achievable” benchmarks aligned to recent production levels (see Carbon Welfare Glossary).140

The bad news for the climate is that many of these demands appear to have been taken on board either by political groups at the European Parliament, or by countries acting as lobbyists for their steel industry.

Top emission trading lobbyists; the biggest profiteers get the best access

Top emission trading lobbyists; the biggest profiteers get the best access

The steel toolkit: massive outreach

From October 2014 to October 2016, access to document requests on emissions trading from DG Clima, Energy, Growth, the office of Commission President Juncker, and Vice President for Better Regulation Timmermans show that ArcelorMittal and Eurofer were the most active industry lobbyists. 141 During this time, they bombarded the Commission with a plethora of position papers, legal studies, requests for in-person meetings, and emails full of demands and exaggerated claims.

According to several MEPs the steel industry has also lobbied the European Parliament extensively.142 Its chief lobbyist, Eurofer Director General Axel Eggerts, maintains good contacts there, having previously worked as the parliamentary assistant to European Peoples Party MEP Karl-Heinz Florenz.143

Legal and technical smokescreens

As part of the ETS review, DG Clima was obliged to make an Impact Assessment.144 The results made harsh reading for the steel sector, debunking claims that the EU ETS would cost it money and showing that it could actually make another €13 billion by passing through non-existent carbon “costs” to consumers.

In response, the steel sector used considerable resources to cloud the credibility of the DG Clima study. For instance, a representative of ArcelorMittal wrote to Timmermans’ cabinet, in November 2014, complaining that the impact assessment was “very flawed” and “structurally misused” by Clima.145

Eurofer then commissioned a rival study from the consultancy Ecofys, which concluded that the steel sector will face €34 billion in direct and indirect costs in the period 2021-2030.146 Civil society groups Carbon Market Watch and Sandbag have shown this new figure to be flawed and inconsistent, however.147

As well as contesting DG Clima’s numbers, Eurofer and ArcelorMittal148 both commissioned legal studies to interpret article 2.9 of the European Council Conclusions of October 2014. Their purpose was to avoid the application of the cross-sectoral correction factor. For example, in a letter to the Head of Cabinet at DG Clima, ArcelorMittal complains that “Unfortunately your services have indicated that they ignore this advice and misinterpret this guidance, by trying to state that this final allocation of the left over ‘’rest’’ means that the correction factor stays. This has no legal basis, rational nor climate purpose, as you can read in the legal opinions.”149

Threats and exaggerations

Another favoured trick from the steel industry’s playbook involves spreading the fear of massive job losses and plant closures, and then blaming these on emissions trading. For example, a letter from 58 CEOs of steel companies sent to heads of states and governments of all EU members, copied to Commission President Juncker, suggested that “this legislation has the potential to make or break the steel industry”.150 In another letter dated November 2014, ArcelorMittal warned Timmermans’ Cabinet that “since its start the original ETS Commission proposals would all have closed most energy intensive industries”.151

ArcelorMittal also sought to pressure Commissioner Cañete by warning of the potential consequences of emissions trading for jobs, noting that the company has “about 100,000 direct employees in Europe, including substantial presence in Spain”.152 The letter goes on to suggest a meeting at which ArcelorMittal “would like to show you the impact [ETS reform scenarios] would have in reality, on each of our main plants in Europe, including Spain”. In fact ArcelorMittal’s Spanish steel plants gained more windfall profits from emissions trading than any other company operating in Spain, totalling an estimated €575 million from 2008-2014.153

As one MEP has explained, the threat of job losses has worked wonders in the European Parliament, where the local steel industry has approached individual MEPs who have a steel factory in their constituency.154 Even MEPs with more progressive views on the ETS reform appear to have caved in to these scaremongering claims. However, declining jobs in the European steel industry are not a result of the ETS or other climate policies, but the result of an oversupply of cheap steel from China, which the EU can do little about because of World Trade Organisation rules.

Oil and Gas: extracting new subsidies

Lobbyists for oil and gas companies, including BP, Statoil, and Shell, have been instrumental in pushing for an EU climate policy focussed on emissions trading, at the expense of ambitious renewable energy and energy efficiency measures. It doesn’t require sleuthing skills to see why: all three companies have put investments in gas at the centre of their strategy, and the ETS potentially rewards this focus.155 In fact, BP and Shell played a historically important role in the creation of the scheme in the first place.156

Oil and gas lobby at a glanceFuelsEuropeLobby spend: €2,250,000€ - €2,499,999157 ShellLobby spend: €4,500,000 - €4,749,000159 BPLobby spend: €2,500,000 - €2,749,000161 |

Oil and gas companies continue to actively lobby on the ETS, with Shell having more emissions trading-related meetings with the EU Commissioners for climate and energy, and their Cabinets, than any other company or trade association.

FuelsEurope, the trade association of multinational oil and gas companies operating refineries in the EU, has been at the centre of the industry’s Brussels lobbying on the details of ETS reform. Its main concerns echo those of the other energy intensive industries (see Carbon Welfare Glossary, above).163

BP, Shell, and Statoil are also part of the Zero Emissions Platform (ZEP), a technology platform for Carbon Capture and Storage (CCS) managed by the lobby consultancy Weber Shandwick.164 They want the Innovation and Modernisation funds to offer generous subsidies for CCS, a controversial promise that carbon will be removed from the atmosphere (allowing for continued burning of fossil fuels) rather than replaced with cleaner energy from renewables.165

Oil and gas companies have also pushed hard for a new loophole for offshore production that could save North Sea operators around €1.7 billion (£1.5 billion).166 The idea is to give offshore oil and gas platforms free emissions permits to cover the electricity they produce for their own use – a measure lobbied for by BP, Shell, Eni, and the International Oil and Gas Producers industry association.167

Oil and gas companies have pushed hard for a new loophole for offshore production that could save North Sea operators around €1.7 billion

This effort appears to have found a champion in Ian Duncan MEP, the ENVI rapporteur, who included an amendment that would give offshore oil producers free permits in his draft report on the revised ETS directive, published on 31 May 2016.168 The report also includes measures that would make it easier for offshore platforms to access “innovation” funding for Carbon Capture and Storage (CCS).

Duncan’s sympathy for the oil and gas lobby should come as no surprise. He has previously boasted of his role in amending EU law “to ensure that onerous emissions reduction targets do not apply to offshore installations”, and that his “energy priorities” include ensuring that “the EU must not pass law that threatens Scotland’s oil and gas industry.”169

The many-faced electricity lobby

There are two main aspects to power sector lobbying on emissions trading: a push to secure the central role of emissions trading in EU climate policy at the expense of renewables and energy efficiency measures, and a focus on maintaining support for fossil fuel power generators in central and Eastern Europe.

The dominant lobbyists here are Eurelectric, the European electricity industry association, and the ‘Magritte Group’ (named after the surrealist painter), which includes ten of Europe’s largest electricity companies – principally those with heavy investments in electricity generation from gas.170 Renewable energy lobbyists play an increasing role too although disturbingly, in recent years fossil fuel companies have moved in to steer these groups towards a joint push for gas.171

Electricity lobby at a glanceMagritte GroupLaunched in May 2013 the group is not registered in the Transparency Register although it is a main player lobbying for energy policies. It meets with high-level EU decision-makers and produces loads of lobbying documents. Its members are registered. IberdrolaLobby spend: €500,000 - €599,999172 CentricaLobby spend: €200,000€ - €299,999174 EnelLobby spend: €2,000,000 - €2,249,999176 EurelectricLobby spend: €500,000 - €599,999178 |

Tougher targets, weaker policies

Throughout the ETS debate Eurelectric has sought to present itself as a champion of tougher climate action, although the truth of its positions is rather more complex. On the positive side, in November 2016 Eurelectric came out in support of increasing the annual emissions reductions required by the ETS to 2.4 per cent (compared to the Commission’s 2.2 per cent proposal) – breaking ranks with the status quo promoted by BusinessEurope.181 This higher goal remains some way short of what the EU would need to do to meet its fair share of global climate commitments, but is at least more consistent with the EU’s own long-term decarbonisation goals.182

At the same time, however, Eurelectric has consistently argued for the ETS as the “cornerstone” of EU climate policy, and used this argument as a defence against measures to promote renewables or energy efficiency. As a Brussels renewable energy lobbyist noted, Eurelectric has “a lot of experts at their office doing nothing but thinking of ways to make life difficult for renewable energy.”183

As a Brussels renewable energy lobbyist noted, Eurelectric has “a lot of experts at their office doing nothing but thinking of ways to make life difficult for renewable energy”

Eurelectric has also argued strongly in favour of Modernisation Funds being controlled by central and eastern European member states (rather than EU institutions), a system that is likely to benefit their continued support for fossil fuel infrastructure.184

The old guard

The Magritte Group (dubbed the “ETS gang”) represents an old guard of fossil fuel producers, despite the fact that it also presents itself as championing climate action – for example, by welcoming measures to cancel some surplus emissions allowances.185 In reality, the Magritte Group is fighting a “cynical” campaign to undermine renewable energy, having made bad strategic choices by investing in new coal and gas plants over the last decade, as Green MEP Claude Turmes has pointed out.186 Its strategy is fairly simple: lobbying in favour of emissions trading and a carbon price as a bulwark against stronger renewable energy and energy efficiency targets. It has also lobbied against renewable energy subsidies, while its members continue to benefit from fossil fuel subsidies.187

The Magritte Group were up to their usual tricks just ahead of the publication of the Winter Package in November 2016, ostensibly supporting a stronger ETS, while at the same time some of its member companies were reportedly suggesting that the EU should avoid tougher energy efficiency measures.188

Fossil fuel subsidies

The second focus of lobbying by electricity generators focuses on the continued provision of free allowances to companies operating in central and eastern Europe (article 10c), and a new Modernisation Fund to support energy generators in the same countries. With article 10c mainly benefitting coal-fired power stations at present, the Commission proposed watering down the power of EU member states to control this funding. Eurelectric has argued against this.189

The Greek state electricity company – supported by amendments put forward to ITRE by Greek MEPs – has also sought access to free emissions permits under article 10c, and Modernisation funding. While there is a good case for extending support to the country after the EU’s imposition of devastating austerity measures, the amendments suggested could actually end up subsidizing the development of new coal-fired power plants in the country.190

Concluding remarks

The ETS – the EU’s flagship programme for tackling climate change – was billed as a system to make big polluters pay. In stark contrast, however, it has been a means for polluters to extract billions in windfall profits, while gaining from loopholes and opt-outs that allow them to avoid taking action to reduce climate change.

The ETS reform directive, which is currently passing through the European Parliament and Council, will inaugurate a fourth phase of emissions trading that extends the scheme to 2030. Each revision has started with the promise of greater environmental integrity, fewer subsidies for polluters, and higher carbon prices.191 But it has failed every time.

Revising the ETS over and over again does not lead to different results, because its basic, flawed premise remains the same: emissions trading creates a market in which the supply side is determined by political decisions, rather than related to demand. And behind those decisions lies a world of heavy lobbying and entrenched interests, where big polluters have a far stronger hand than the handful of public interest groups hoping for incremental changes to make the scheme better.

This report has exposed just how strong the hand of the corporate lobbyists is. A loophole extending free permits in response to largely fictional “carbon leakage”, which was opened up by energy-intensive industry lobbying in 2009, has now become a chasm.192 This time around, lobbyists have convinced the Commission to adopt a reform (based on Council recommendations) that would offer them €160 billion in free pollution permits. Further lobbying on the Parliament suggests that total could reach over €175 billion.

A compensation scheme for big polluters’ electricity bills could add another €58 billion to that total, while further loopholes could be put in place for offshore oil producers, and even coal plants. Coming on the back of billions in windfall profits that big energy companies and industry have already made from the ETS, these proposals amount to the extension of a massive subsidy scheme for big business. And it is ordinary people who pick up the bill.

Underpinning this carbon welfare system is a story that serious climate policy is a threat to European competitiveness. This narrative needs to be challenged far more robustly. As the Commission’s own study found, ‘carbon leakage’ remains a myth.

There is certainly some truth in the story that heavy industry, and the jobs it provides, are under severe threat in the EU. But this has little or nothing to do with climate policy. Free trade deals (and the World Trade Organisation) have exposed European producers to cheaper competition, while low global shipping costs, cheap labour, and poor working conditions have made it cheaper to produce outside the EU.

Understanding that backdrop can also help clarify the nature of the threat that corporate lobbyists are making when they talk about carbon leakage. In effect, many lobbyists are saying that the companies they represent might move their factories elsewhere to secure greater profits, unless the EU offers them subsidies to increase their profits here. There’s a word for that and it isn’t ‘leakage’ – it’s blackmail.

In response to this distortion of the climate debate, two things should happen that go far beyond the tweaking of emissions targets within the ETS or closing a few loopholes.

First, the Commission needs to re-evaluate who it is meaningfully engaging when making policy, and keep corporate lobbyists at arms-length. Article 5.3 of the WHO Framework Convention on Tobacco Control and its accompanying guidelines provide a positive example: it suggests decision-makers should restrict their interactions with the tobacco industry to the imposition of regulations, while ensuring that whatever interactions are necessary are conducted transparently.193 The Commission, and also the European Parliament, the Council, and member states, would all do well do follow suit with the lobbyists of big polluters, with regard to climate change policy.

Second, it is time to recognise that emissions trading is beyond repair. As we have shown in our Life Beyond Emissions Trading report, there are a whole set of measures that could help the EU move beyond emissions trading, creating more and better jobs in the process.194 Instead of paying the polluters, the EU should be looking to bolster its energy efficiency policies and targets, subsidise renewables, and invest in a Just Transition to a fairer and cleaner economy. The time for carbon welfare is long past.